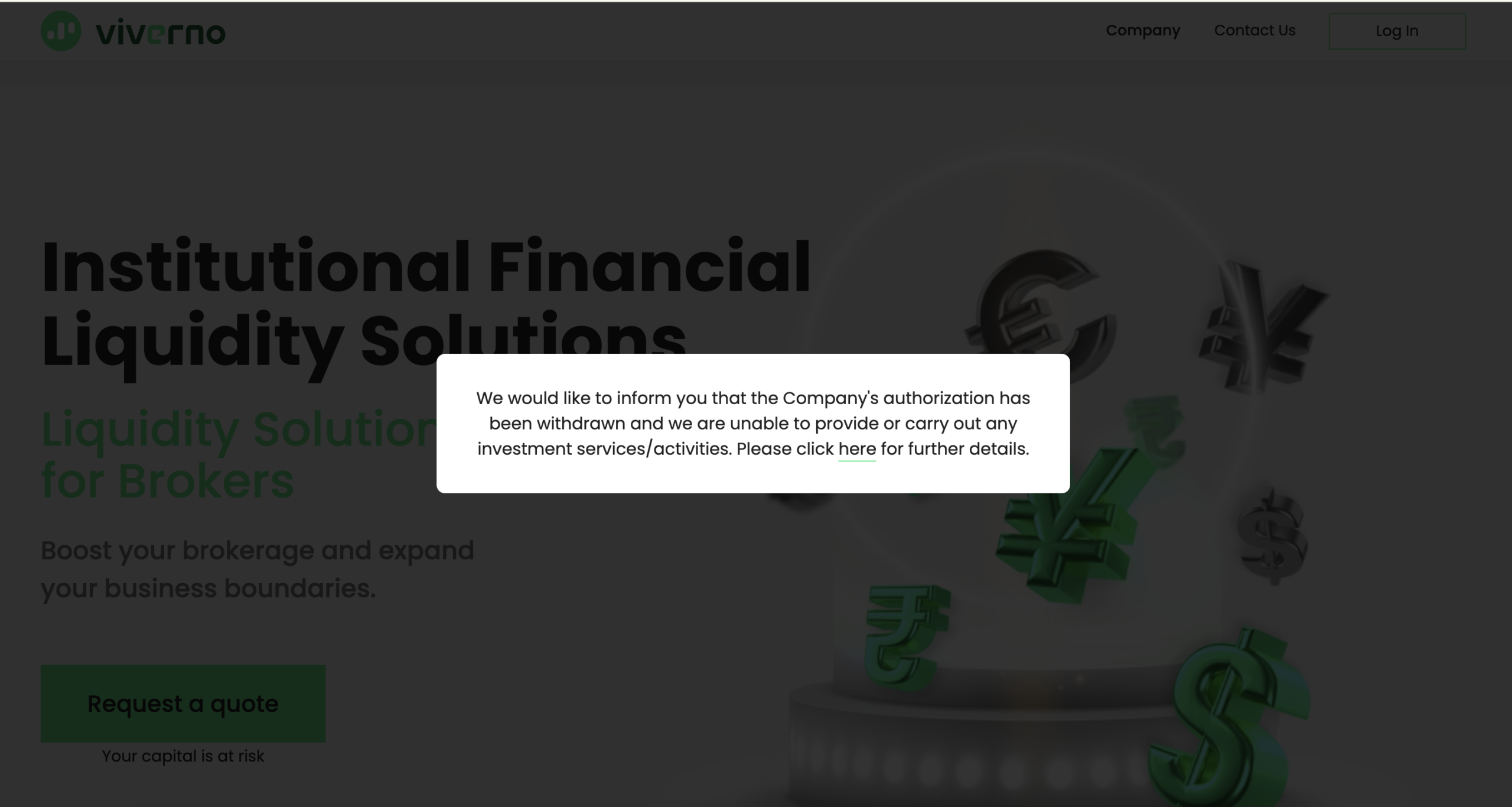

In the ever-growing world of online trading, new brokers emerge daily, promising lucrative returns, low fees, and cutting-edge trading platforms. Among them, Viverno.com positioned itself as a modern, sophisticated Forex and CFD broker, offering everything from currency pairs to commodities, indices, and stocks. On the surface, it appeared professional, complete with tiered accounts, MetaTrader integration, and claims of regulatory compliance. However, beneath its polished exterior, Viverno.com revealed a series of red flags that raise serious concerns about its legitimacy and trustworthiness. This article provides a detailed review of Viverno.com, explaining why it has been widely classified as a scam platform by experts and users alike.

What is Viverno.com?

Viverno.com presented itself as a broker for retail and institutional traders alike. The platform offered multiple account types, including “Classic,” “Raw,” and “VIP,” each with varying spreads, deposit requirements, and trading conditions. Users could theoretically trade major currency pairs, commodities, indices, and stocks, with the promise of deep liquidity and robust trading tools.

The platform also promoted compatibility with popular trading software, including MetaTrader 5 (MT5), widely used by professional traders worldwide. It claimed to provide competitive spreads, fast execution, and a secure trading environment. For many inexperienced traders, such offerings can appear highly legitimate, combining the hallmarks of reputable brokers: tiered accounts, standard platforms, and diversified products.

Regulatory Issues: License Suspension and Revocation

Despite its claims of operating under regulatory oversight, Viverno.com faced significant regulatory challenges that ultimately exposed its operations as unsafe. The company had previously claimed to operate under a Cypriot investment license, presenting itself as a regulated firm.

However, regulatory authorities eventually determined that Viverno.com failed to meet essential compliance requirements. In late 2024, its license was suspended, with authorities citing the absence of proper corporate management and a failure to operate in accordance with regulatory standards. This suspension prohibited the platform from onboarding new clients, conducting investment services, or advertising as a legitimate financial services provider.

By mid-2025, Viverno.com’s license was permanently revoked due to prolonged inactivity and non-compliance. This revocation meant that the company was no longer legally authorized to operate as a regulated broker, rendering all claims of regulation null and void. Any prior statements about regulatory compliance became misleading, as Viverno.com could no longer lawfully provide financial services.

User Experiences: Complaints and Poor Feedback

One of the clearest indicators of Viverno.com’s unreliability comes from real user experiences. Across various review platforms, the overwhelming consensus among former clients is negative. Users consistently report issues such as:

-

Difficulty withdrawing funds: Many clients claimed their withdrawal requests were delayed indefinitely or ignored entirely.

-

Poor customer support: Communication with the platform was reportedly slow or non-existent, leaving users frustrated and without answers.

-

Misleading claims: Viverno.com’s promises of a fully operational, regulated trading platform did not align with user experiences, particularly regarding financial transactions.

These consistent complaints suggest a pattern of neglect or deceptive practices, particularly given the platform’s regulatory suspension and eventual license revocation.

Technical Appearance vs. Actual Legitimacy

Viverno.com maintained a professional online presence. The website featured an SSL certificate, a clean interface, and functional trading platform integration. At first glance, it resembled a legitimate broker, and many users may have been reassured by its appearance.

However, technical presentation alone does not guarantee trustworthiness. Scams often rely on visually convincing websites to establish credibility while engaging in deceptive practices behind the scenes. Viverno.com is a prime example: despite a polished user interface, it failed to uphold basic obligations, such as regulatory compliance and client fund management.

Red Flags That Signal Risk

Several aspects of Viverno.com’s operations should have raised alarms for potential clients:

-

License Revocation: The platform is no longer a regulated broker, making any prior claims of oversight invalid.

-

User Complaints: Widespread reports of unreturned funds, withdrawal delays, and unresponsive support suggest systemic issues.

-

Corporate Inactivity: Regulatory authorities highlighted that Viverno.com had not conducted legitimate investment services for months prior to license revocation.

-

Misleading Marketing: Despite its professional appearance and claims of regulatory status, Viverno.com misrepresented its legal standing, creating a false sense of security for users.

These red flags collectively indicate that Viverno.com cannot be trusted as a legitimate trading platform.

Patterns Observed in Failed Brokers

Viverno.com’s trajectory reflects a familiar pattern observed in the online trading industry. Scammers often use the following strategies:

-

Polished branding and marketing: The platform appears legitimate, with professional graphics, user-friendly websites, and software integration.

-

Misleading regulatory claims: They assert that they are regulated to build credibility, even if licenses are suspended or revoked.

-

Customer exploitation: Deposits are accepted, but withdrawals and services are delayed or denied.

-

Regulatory intervention: Authorities eventually intervene, often after significant client losses, leaving the platform to either shut down or operate illegally.

Viverno.com fits this pattern, combining a professional façade with regulatory and operational failures.

Why Viverno.com Is Considered a Scam

Taking into account regulatory action, user complaints, and operational failures, there are several reasons why Viverno.com is widely classified as a scam:

-

Loss of Regulation: Without a valid license, the platform is legally prohibited from offering financial services.

-

Non-Compliance: The company failed to meet basic regulatory standards, including active management and proper client fund handling.

-

Unreliable User Experiences: Complaints about unreturned funds and poor communication undermine any trust in the platform.

-

Deceptive Practices: Claims of regulation and legitimacy were misleading, creating a false sense of security for clients.

In combination, these factors make Viverno.com extremely risky and untrustworthy for traders of all experience levels.

Lessons from Viverno.com

Viverno.com serves as a cautionary example for anyone exploring online trading. Even a professional-looking website and promises of high returns cannot substitute for regulatory compliance and transparent operations. Key takeaways include:

-

Always verify regulation: Check with official financial authorities before depositing money with any broker.

-

Consider user reviews: Patterns of complaints often reveal systemic issues long before official intervention occurs.

-

Look beyond the website: SSL certificates and clean interfaces do not guarantee legitimacy.

-

Avoid brokers with recent inactivity or license issues: These are strong indicators of underlying operational problems.

By following these principles, traders can better protect themselves from risky platforms that appear legitimate but fail to uphold industry standards.

Steps to Take After Being Scammed

- Stop All Communication: Once you realize you’ve been scammed, stop any communication with the fraudulent platform. Scammers may try to manipulate you into making further deposits by claiming there’s a way to recover your initial investment.

- Document Everything: Collect all relevant evidence of your transactions and communications with the platform. This includes screenshots of conversations, transaction receipts, and any emails or documents provided by the scam broker.

- Report the Scam: It is important to report the scam to the authorities and relevant online platforms. Websites like LOSTFUNDSRECOVERY.COM provide a detailed process for reporting cryptocurrency scams and ensuring they are documented for investigation.

- Seek Professional Help: Crypto scams are complex and often require professional assistance to recover lost funds. This is where services like LOSTFUNDSRECOVERY.COM come into play.

How LostFundsRecovery.com Can Help You Recover from the Scam

If you have been a victim of the Viverno.com scam, all hope is not lost. Recovery firms like LostFundsRecovery.com specialize in helping scam victims retrieve their lost funds. Here’s how LostFundsRecovery.com can assist:

1. Investigating the Fraud

LostFundsRecovery.com conducts thorough investigations into scam brokers. By analyzing transactions, tracking digital footprints, and gathering evidence, they build a strong case against fraudulent platforms like Viverno.com.

2. Chargeback Assistance

Many victims who deposit funds via credit or debit cards may be eligible for chargebacks. LostFundsRecovery.com guides clients through the chargeback process by providing necessary documentation and liaising with banks and financial institutions.

3. Cryptocurrency Transaction Tracing

If you deposited funds in cryptocurrency, recovery can be more challenging. However, LostFundsRecovery.com uses blockchain analysis tools to track and trace stolen digital assets. Identifying wallet addresses and transaction histories can provide crucial leads in fund recovery.

4. Legal Support

LostFundsRecovery.com collaborates with legal experts to take action against scam brokers. Depending on the jurisdiction, they can help file complaints with financial regulators, law enforcement, and cybersecurity agencies.

5. Prevention and Education

In addition to fund recovery, LostFundsRecovery.com educates victims on avoiding future scams. By raising awareness about fraudulent schemes, they help investors make informed decisions and safeguard their assets.

Recommendations for Investors Considering Viverno.com

If you are thinking about trading through Viverno.com, or you are an existing user, here are practical suggestions to improve your experience and protect your investments:

-

Verify the Website: Always type Viverno.com directly into your browser rather than clicking on external links.

-

Use Strong Security Measures: Implement strong passwords and enable two-factor authentication to safeguard your account.

-

Keep Records of Transactions: Document all trades, withdrawals, and account changes to address any potential issues efficiently.

-

Start Small: If you are new to Viverno.com, consider starting with small trades to test the platform before committing larger sums.

-

Stay Informed: Monitor account activity regularly and stay updated on any platform announcements or changes to services.

-

Compare Alternatives: Consider whether other brokers offer lower fees, better support, or smoother platforms depending on your trading style.

These steps can help mitigate risks while using Viverno.com and ensure a smoother investment experience.

Report Viverno.com Scam and Recover Your Funds

If you have lost money to Viverno.com, it’s important to take action immediately. Report the scam to LOSTFUNDSRECOBERY.COM, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like CommSec.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud. Read More reviews at Scams2Avoid

Stay smart. Stay safe.

Conclusion

Viverno.com once presented itself as a promising online trading platform with professional account options, modern trading tools, and a wide array of products. Yet beneath its polished surface, it failed to deliver on basic obligations such as regulatory compliance, fund management, and customer support. Regulatory authorities suspended and ultimately revoked its license, while users consistently reported difficulties accessing their funds and unresponsive service.

For anyone considering Forex or CFD trading, Viverno.com represents a clear warning: appearances can be deceiving, and due diligence is essential. Despite claims of regulation and technical sophistication, Viverno.com cannot be trusted as a safe or legitimate broker. This case underscores the importance of verifying regulatory status, reviewing user experiences, and approaching online brokers with caution, no matter how professional they appear.

In the high-stakes world of online trading, one wrong choice can cost you your investment — and Viverno.com exemplifies how quickly a seemingly credible platform can turn into a high-risk, untrustworthy operation. Traders must always remain vigilant and informed to avoid falling prey to platforms that fail to meet basic standards of legitimacy and accountability.