In recent years, many online platforms have emerged claiming to provide advanced financial services and investment solutions. One such platform is Pcrinsights.com, which markets itself as a sophisticated financial data aggregation and wealth management service. On the surface, PCRInsights.com appears to cater to institutional clients, family offices, and wealth-tech firms, offering services that promise to simplify complex financial portfolios. However, upon closer examination at PCRInsights.com there are several red flags that warrant caution. PCRInsights.com takes an in-depth look at the platform, its claims, and why it may not be as trustworthy as it appears.

What is PCRInsights.com?

PCRInsights.com presents itself as a business-to-business (B2B) provider of financial data aggregation and portfolio management solutions. The platform claims to offer a wide range of services, including:

-

Consolidating investment data from custodial and alternative investment accounts.

-

Providing integrated portfolio reporting tools.

-

Offering statement operations, data publishing, and reporting suites.

According to the platform, it serves hundreds of financial firms globally and manages hundreds of billions of dollars in assets across thousands of accounts. These services are positioned for clients such as private banks, registered investment advisors, family offices, and institutional allocators.

While the claims sound impressive, there is limited public evidence to verify these assertions. The lack of transparency raises questions about the legitimacy of the platform and whether it operates at the scale it claims.

Red Flags and Concerns

Several aspects of PCRInsights.com suggest that potential clients should exercise extreme caution before engaging with the platform.

1. Limited Public Footprint

For a company that claims to manage billions of dollars and serve hundreds of clients, PCRInsights.com has an extremely limited public presence. Legitimate firms at this scale typically have verifiable client testimonials, independent reviews, and press coverage. The near absence of these indicators makes it difficult to confirm whether the platform genuinely serves the financial institutions it claims to support.

2. Sparse Reviews

PCRInsights.com has very few online reviews, and the few that exist are not verified or substantiated by independent sources. A legitimate enterprise of its purported size would likely have a more extensive track record of client feedback. The lack of reviews raises questions about whether the company is transparent about its services or if it has ever delivered on its promises.

3. Exaggerated Claims

The platform’s statements about managing hundreds of billions of dollars in assets and integrating with thousands of custodians appear highly ambitious. While these claims may serve as marketing tools, the absence of supporting evidence makes them suspicious. Without verifiable references, it is impossible to confirm the accuracy of these statements.

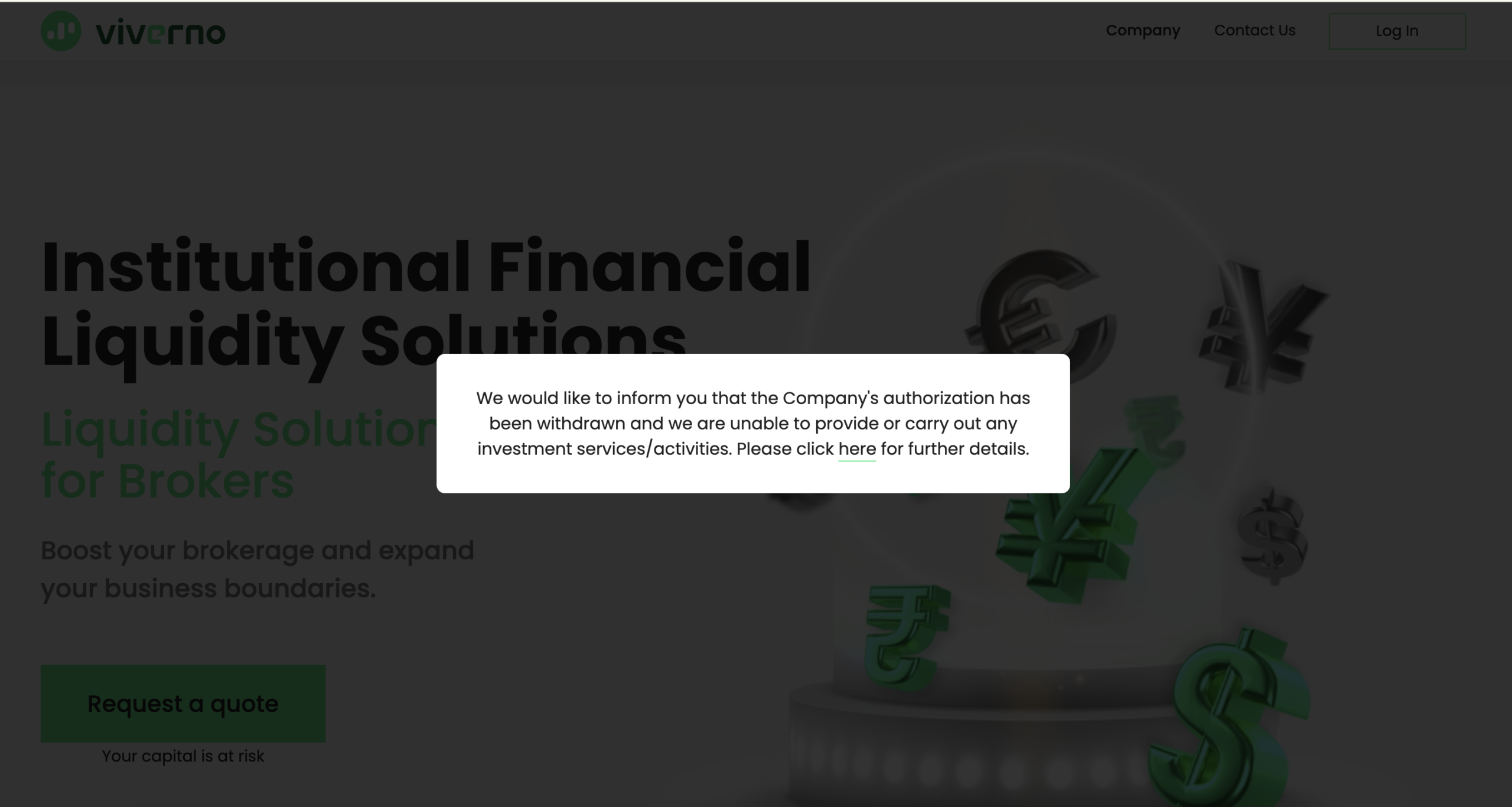

4. Lack of Regulatory Transparency

There is no publicly available information indicating that PCRInsights.com is regulated by financial authorities or subject to independent audits. Legitimate financial service providers handling sensitive data and client assets typically maintain clear regulatory compliance and security certifications. The absence of such verification introduces further risk for potential clients.

5. Potential Misalignment of Services

PCRInsights.com positions itself as a backend provider for wealth management firms, yet there is minimal evidence of operational scale or client adoption. The mismatch between the platform’s claims and the lack of observable outcomes suggests that prospective clients could be misled about the company’s capabilities.

Why People Might Be Drawn In

Despite the concerns outlined above, PCRInsights.com may appear credible to some users because of the following factors:

-

Sophisticated Industry Jargon: Terms like “custodial aggregation,” “alternative investment integration,” and “portfolio reporting” give the impression of professional, institutional-grade services.

-

Impressive-Sounding Numbers: Claims of managing hundreds of billions in assets and serving hundreds of firms suggest scale and reliability, even if unverified.

-

Professional Website Presentation: The website is designed to look polished and authoritative, which may create a false sense of trust.

These factors can make the platform appealing to those unfamiliar with financial data aggregation, particularly individuals or organizations seeking an efficient solution for complex investment portfolios.

What We Know and Don’t Know

It is important to separate verifiable facts from speculation.

What we know:

-

PCRInsights.com claims to provide financial data aggregation and reporting services.

-

The platform targets institutional clients rather than retail investors.

-

There is extremely limited public evidence supporting the scale of the operation or client base.

What we don’t know:

-

Whether the company genuinely manages the claimed assets or serves the stated number of clients.

-

If the platform’s operations are fully compliant with relevant financial regulations.

-

Whether clients have successfully used the platform and received reliable services.

This uncertainty makes engaging with PCRInsights.com inherently risky.

Steps to Take After Being Scammed

- Stop All Communication: Once you realize you’ve been scammed, stop any communication with the fraudulent platform. Scammers may try to manipulate you into making further deposits by claiming there’s a way to recover your initial investment.

- Document Everything: Collect all relevant evidence of your transactions and communications with the platform. This includes screenshots of conversations, transaction receipts, and any emails or documents provided by the scam broker.

- Report the Scam: It is important to report the scam to the authorities and relevant online platforms. Websites like LOSTFUNDSRECOVERY.COM provide a detailed process for reporting cryptocurrency scams and ensuring they are documented for investigation.

- Seek Professional Help: Crypto scams are complex and often require professional assistance to recover lost funds. This is where services like LOSTFUNDSRECOVERY.COM come into play.

How LostFundsRecovery.com Can Help You Recover from the Scam

If you have been a victim of the PCRInsights.com scam, all hope is not lost. Recovery firms like LostFundsRecovery.com specialize in helping scam victims retrieve their lost funds. Here’s how LostFundsRecovery.com can assist:

1. Investigating the Fraud

LostFundsRecovery.com conducts thorough investigations into scam brokers. By analyzing transactions, tracking digital footprints, and gathering evidence, they build a strong case against fraudulent platforms like PCRInsights.com.

2. Chargeback Assistance

Many victims who deposit funds via credit or debit cards may be eligible for chargebacks. LostFundsRecovery.com guides clients through the chargeback process by providing necessary documentation and liaising with banks and financial institutions.

3. Cryptocurrency Transaction Tracing

If you deposited funds in cryptocurrency, recovery can be more challenging. However, LostFundsRecovery.com uses blockchain analysis tools to track and trace stolen digital assets. Identifying wallet addresses and transaction histories can provide crucial leads in fund recovery.

4. Legal Support

LostFundsRecovery.com collaborates with legal experts to take action against scam brokers. Depending on the jurisdiction, they can help file complaints with financial regulators, law enforcement, and cybersecurity agencies.

5. Prevention and Education

In addition to fund recovery, LostFundsRecovery.com educates victims on avoiding future scams. By raising awareness about fraudulent schemes, they help investors make informed decisions and safeguard their assets.

Recommendations for Investors Considering PCRInsights.com

If you are thinking about trading through PCRInsights.com, or you are an existing user, here are practical suggestions to improve your experience and protect your investments:

-

Verify the Website: Always type PCRInsights.com directly into your browser rather than clicking on external links.

-

Use Strong Security Measures: Implement strong passwords and enable two-factor authentication to safeguard your account.

-

Keep Records of Transactions: Document all trades, withdrawals, and account changes to address any potential issues efficiently.

-

Start Small: If you are new to PCRInsights.com, consider starting with small trades to test the platform before committing larger sums.

-

Stay Informed: Monitor account activity regularly and stay updated on any platform announcements or changes to services.

-

Compare Alternatives: Consider whether other brokers offer lower fees, better support, or smoother platforms depending on your trading style.

These steps can help mitigate risks while using PCRInsights.com and ensure a smoother investment experience.

Report PCRInsights.com Scam and Recover Your Funds

If you have lost money to PCRInsights.com, it’s important to take action immediately. Report the scam to LOSTFUNDSRECOBERY.COM, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like PCRInsights.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud. Read More reviews at Scams2Avoid

Stay smart. Stay safe.

Conclusion

PCRInsights.com presents itself as a sophisticated financial data aggregation and portfolio management platform with extensive reach and capabilities. On the surface, it targets high-end institutional clients and positions itself as a professional, enterprise-grade service provider.

However, the lack of verifiable evidence regarding client adoption, regulatory compliance, and operational scale raises significant concerns. While it is possible that PCRInsights.com operates legitimately on a small scale, its claims are difficult to confirm and should be approached with caution.

Potential clients are advised to conduct thorough due diligence and require independent verification before trusting PCRInsights.com with sensitive financial data or access to investment accounts. The combination of ambitious claims, limited public footprint, and minimal reviews makes the platform inherently high-risk.

In short: treat PCRInsights.com with skepticism and demand concrete proof of legitimacy before engagement.