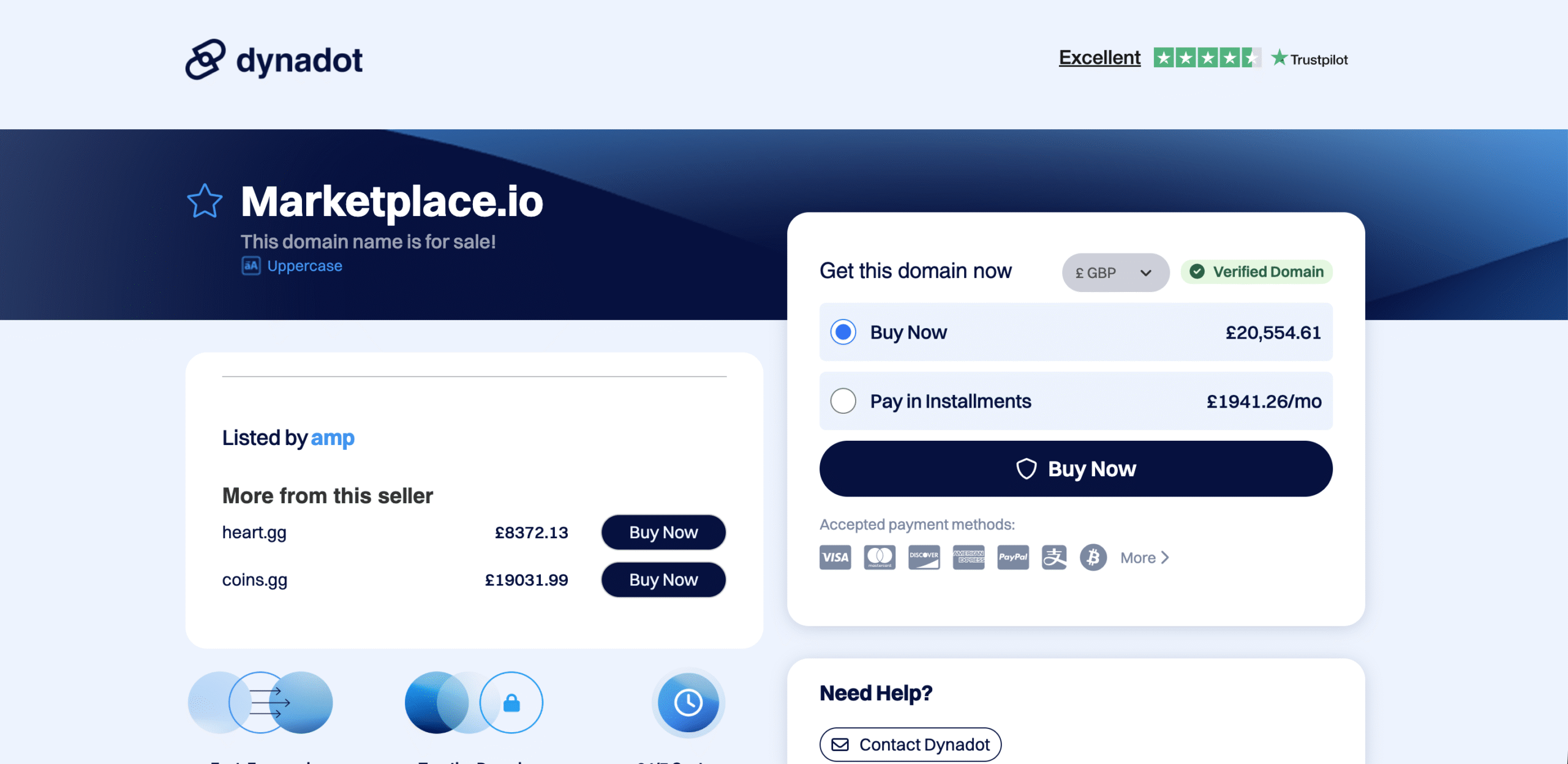

Marketplace.io has positioned itself as a modern, tech-forward platform promising access to trading, investment tools, or digital asset opportunities wrapped in sleek design and confident messaging. To a casual visitor, it looks polished, current, and aligned with the language of legitimate fintech platforms.

Yet beneath that surface, a growing number of users report the same troubling outcomes: inaccessible funds, shifting rules around withdrawals, aggressive account managers, and silence once deposits stop flowing.

This article breaks down five high-risk gaps embedded in Marketplace.io’s structure—issues many users fail to recognize until capital is already locked inside the system.

Gap 1: Identity Without Accountability

Marketplace.io does not clearly disclose:

-

A verifiable corporate entity

-

Named directors or executives

-

A confirmed operating jurisdiction

-

Any regulator-issued license

This absence is not a technical oversight. Legitimate financial platforms publish this information because they are required to. Marketplace.io replaces accountability with vague compliance language that cannot be independently confirmed.

When ownership is hidden, users have no legal counterpart to pursue if funds are frozen or misused.

Gap 2: Simulated Activity Presented as Performance

Users commonly report that balances begin increasing shortly after deposit. Dashboards show movement, charts update, and profits appear to accumulate.

However, there is no evidence that these figures are linked to:

-

Real exchanges

-

External liquidity providers

-

Verifiable transaction IDs

-

Third-party execution records

Without independently verifiable trade data, displayed performance becomes nothing more than an internal visual tool—one fully controlled by the platform itself.

Gap 3: Withdrawal Rules That Shift Midway

Before funding an account, withdrawals are described as seamless. After funding, users encounter unexpected conditions such as:

-

New verification requirements

-

“Release,” “processing,” or “tax” fees

-

Minimum balance thresholds not previously disclosed

-

Requests for additional deposits to enable withdrawals

This pattern shows a system designed to encourage deposits first and negotiate exits later—a fundamental structural risk.

Gap 4: Deposit-Driven Account Management

Marketplace.io frequently assigns users an “account manager.” Rather than providing neutral support, these representatives often:

-

Push for larger deposits

-

Frame withdrawals as missed opportunities

-

Apply urgency and market-pressure language

-

Become less responsive once deposits stop

This is not advisory behavior—it mirrors sales-driven conversion tactics. When financial guidance prioritizes inflows over client control, risk increases dramatically.

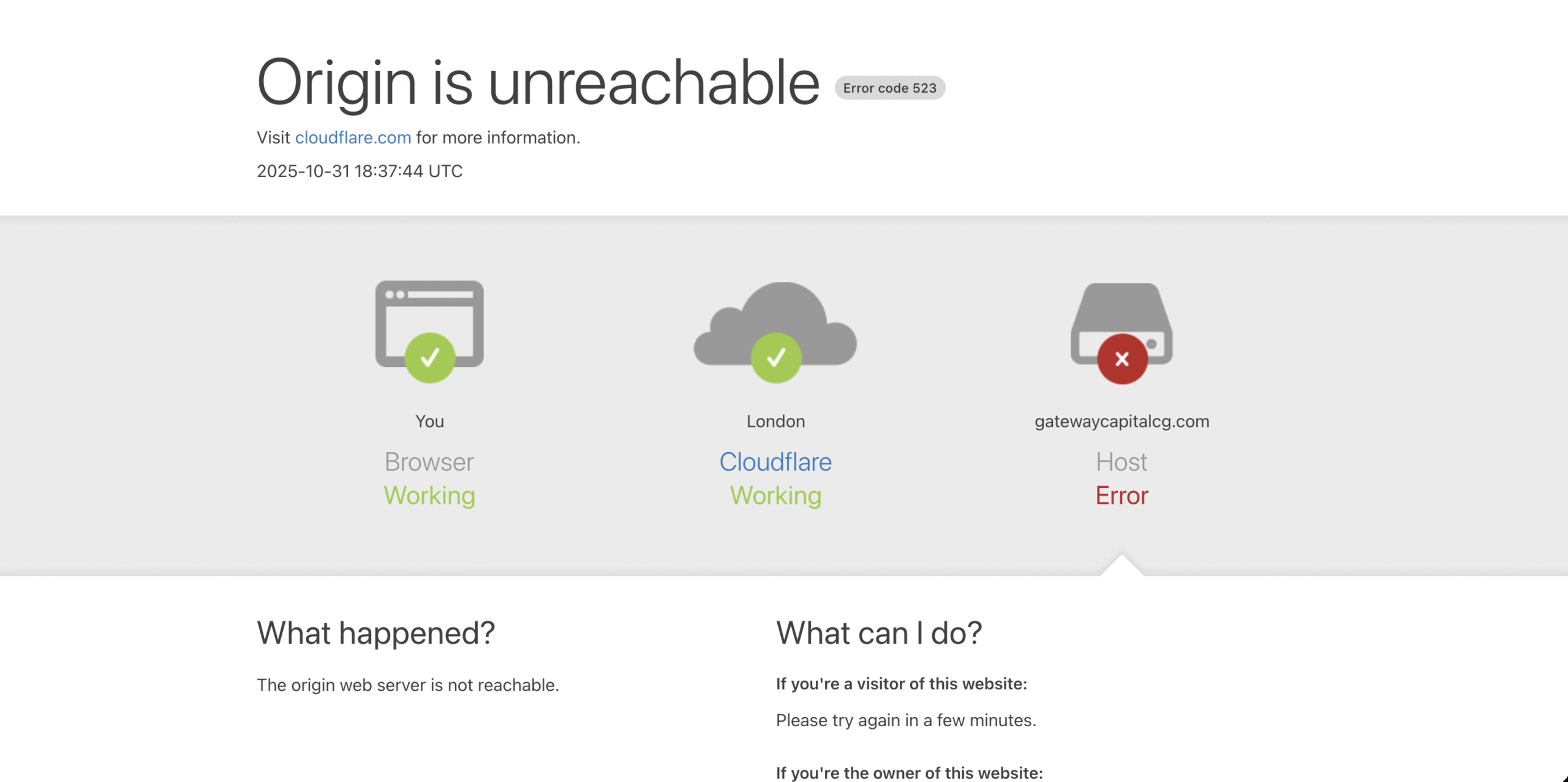

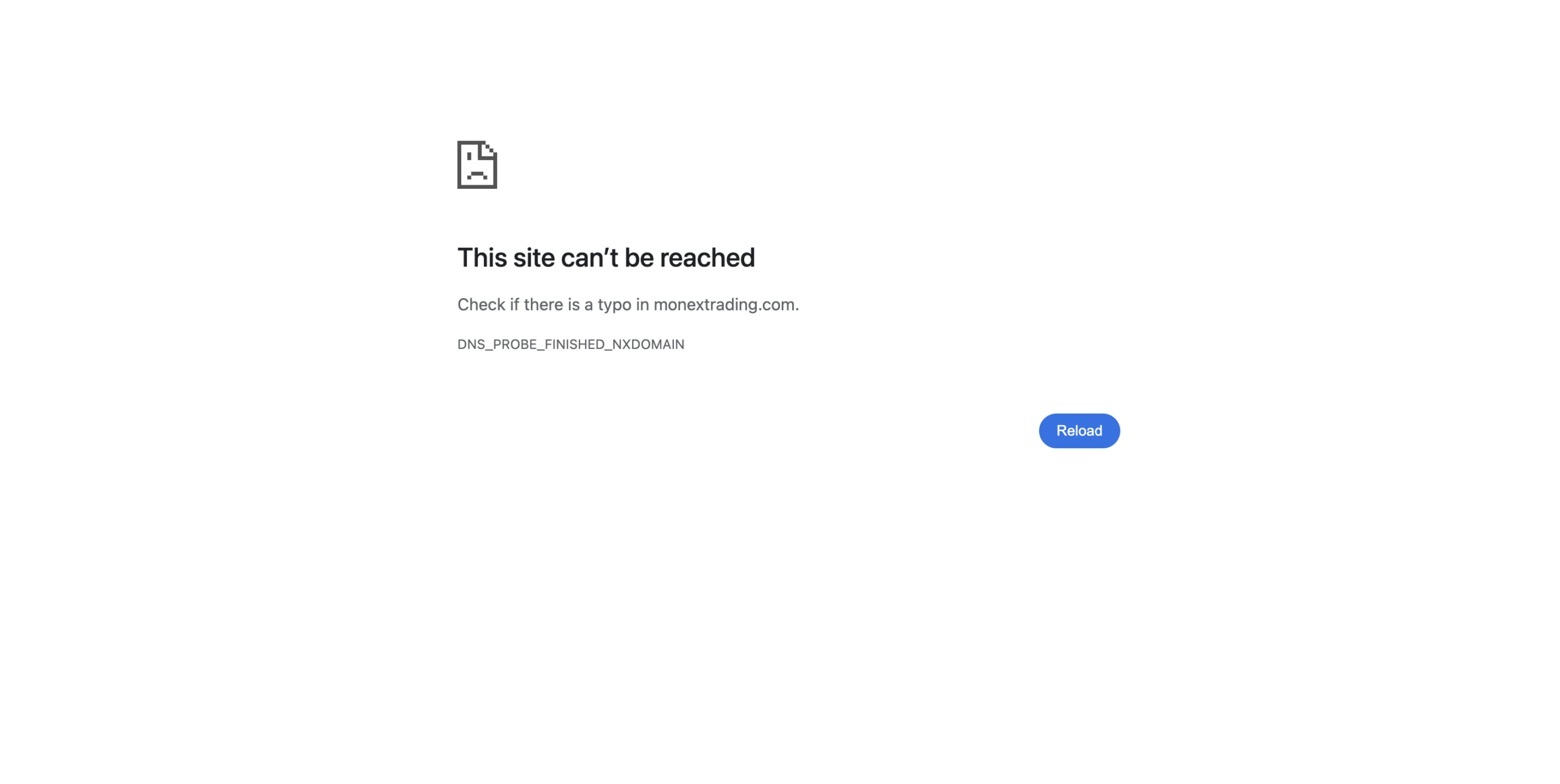

Gap 5: A Platform Built to Be Replaced

Several indicators suggest Marketplace.io is designed for short operational cycles:

-

Recently registered domain

-

Ownership shielded by privacy services

-

Interface templates identical to other flagged platforms

-

Reusable branding structure

This makes it easy for operators to abandon the platform and relaunch under a new name once complaints escalate—leaving users without recourse.

What Affected Users Commonly Report

Across complaint channels, the same sequence appears repeatedly:

-

Initial deposit encouraged as low risk

-

Dashboard displays growth

-

Pressure to add more funds

-

Withdrawal attempt triggers complications

-

Support responsiveness declines

-

Account access becomes restricted

Consistency across unrelated users indicates system design—not isolated service failures.

Why These Gaps Go Unnoticed Early

Marketplace.io relies on modern trust signals:

-

Professional UI design

-

Familiar fintech terminology

-

AI and automation narratives

-

Confident, personalized communication

These elements create credibility quickly, often suppressing early skepticism. By the time doubts emerge, capital is already locked behind platform-controlled conditions.

What To Do If Funds Are Already Stuck

If you have already deposited funds and are facing withdrawal resistance, the priority is documentation and escalation—not further payments.

At that stage, some users choose to seek external guidance through a book consultation to better understand recovery options, evidence preparation, and next steps before the platform becomes unreachable.

Key Takeaways for Investors

-

Anonymous platforms eliminate accountability

-

Unverifiable dashboards are not proof of performance

-

Withdrawal conditions should never change post-deposit

-

Sales pressure is incompatible with fiduciary behavior

-

Disposable platforms signal elevated risk

Marketplace.io’s structure places control firmly on the platform side—not the user’s.

How Scammers Build Trust

Understanding their psychological playbook helps you recognize and resist future scams. The Marketplace.io strategy involves:

-

Authority appeal:

Scammers claim to work with analysts or firms that sound official but have no online trace. -

Scarcity and urgency:

Victims are told an “investment window” is closing or that they’ve been “personally selected” for a lucrative offer. -

Social proof:

They reference other “happy investors” or show fake dashboards of supposed clients making huge profits. -

Reciprocity:

The scammer may “help” you with a small issue at first — like guiding you through registration — to make you feel indebted and more likely to comply later. -

Commitment bias:

Once you’ve deposited once, they’ll remind you of your earlier decision to reinforce consistency and pressure you to deposit more.

The Broader Pattern — Clone Scams

Marketplace.io is not unique; it’s part of a larger ecosystem of cloned trading scams. These fraudulent websites share similar layouts, language, and business models. Once one domain gains too much negative publicity, the operators simply launch a new one using the same infrastructure. This recycling of scams makes it difficult for new investors to distinguish the copycats from genuine platforms.

Common naming strategies include:

-

Using professional-sounding tech terms (like “Market,” “Trade,” “Capital,” “Exchange,” “Pro”).

-

Registering domains with “.io” or “.co” endings to appear modern or international.

-

Copying content from legitimate brokers, slightly altering company names or license numbers.

The Emotional Aftermath of Marketplace.io

Many victims of Marketplace.io describe more than just financial pain — the emotional toll can be severe. Feelings of betrayal, embarrassment, and distrust linger long after the money is gone. Some individuals hesitate to invest or even bank online again. Recognizing these emotional effects is crucial, as scammers often rely on victims’ silence to continue operating unnoticed.

Lessons Learned On Marketplace.io

The Marketplace.io saga serves as a powerful reminder of the importance of due diligence. Key lessons include:

-

Always verify regulation independently.

Visit official regulator websites and search the company’s name or license number. Never rely on screenshots or “certificates” shown on the platform. -

Be skeptical of high returns.

Consistent, guaranteed profit does not exist in legitimate markets. -

Avoid unverified payment channels.

Stick to trusted payment methods that offer protection and traceability. -

Do not rush.

Pressure to act quickly is a psychological tactic. Real investment opportunities never expire overnight. -

Research reviews critically.

Identify authentic user feedback rather than paid or automated testimonials. -

Protect personal data.

Only share identification documents with regulated entities and through secure channels.

Building Awareness

One of the most effective defenses against scams like Marketplace.io is awareness. Sharing accurate information through blogs, forums, and community discussions helps prevent others from falling victim. Transparency exposes fraudulent operations faster and limits their ability to rebrand undetected.

Readers are encouraged to discuss their experiences openly. Doing so removes the stigma victims often feel and transforms isolated incidents into collective knowledge.

Why Regulation Matters

Financial regulation exists to safeguard investors. Licensed brokers must follow strict requirements:

-

Client fund segregation: keeping customer money separate from company funds.

-

Capital adequacy: maintaining reserves to ensure solvency.

-

Regular audits and transparency: proving that client transactions are real and fairly priced.

-

Dispute resolution channels: providing a legal pathway for complaints and compensation.

Unregulated entities like Marketplace.io ignore all these safeguards. They can disappear overnight without consequence. The lack of accountability is what enables them to defraud thousands of people with near impunity.

How Scams Evolve Over Time

Marketplace.io’s operators demonstrate how modern online fraud adapts. Years ago, scammers relied on crude websites and obvious lies. Today, they use professional branding, advertising algorithms, and social-media micro-targeting to reach specific demographics. They analyze investor psychology as carefully as legitimate marketers — only their goal is theft, not service.

The trend is especially dangerous because scams are becoming more convincing. Automated chatbots, fake AI-based dashboards, and deepfake testimonials blur the line between real and fake. In this environment, skepticism and independent verification are not optional; they are survival tools.

The Cost Beyond Money

Online fraud has broader consequences for digital trust. Every time a scam like Marketplace.io succeeds, it erodes confidence in online investment platforms in general. Honest startups and legitimate fintech companies suffer collateral damage as consumers become wary of all digital finance ventures. This collective loss of trust slows innovation and investment in the broader fintech ecosystem.

Platform Risk Summary

Marketplace.io presents itself as innovative and opportunity-driven, but closer inspection reveals systemic gaps that expose users to loss through design rather than market volatility.

For investors who prioritize transparency, verifiability, and control, these gaps represent risks that cannot be mitigated through strategy or timing—only avoidance.

Staying skeptical, verification-focused, and exit-aware remains the most reliable defense against platforms built on appearance rather than accountability.