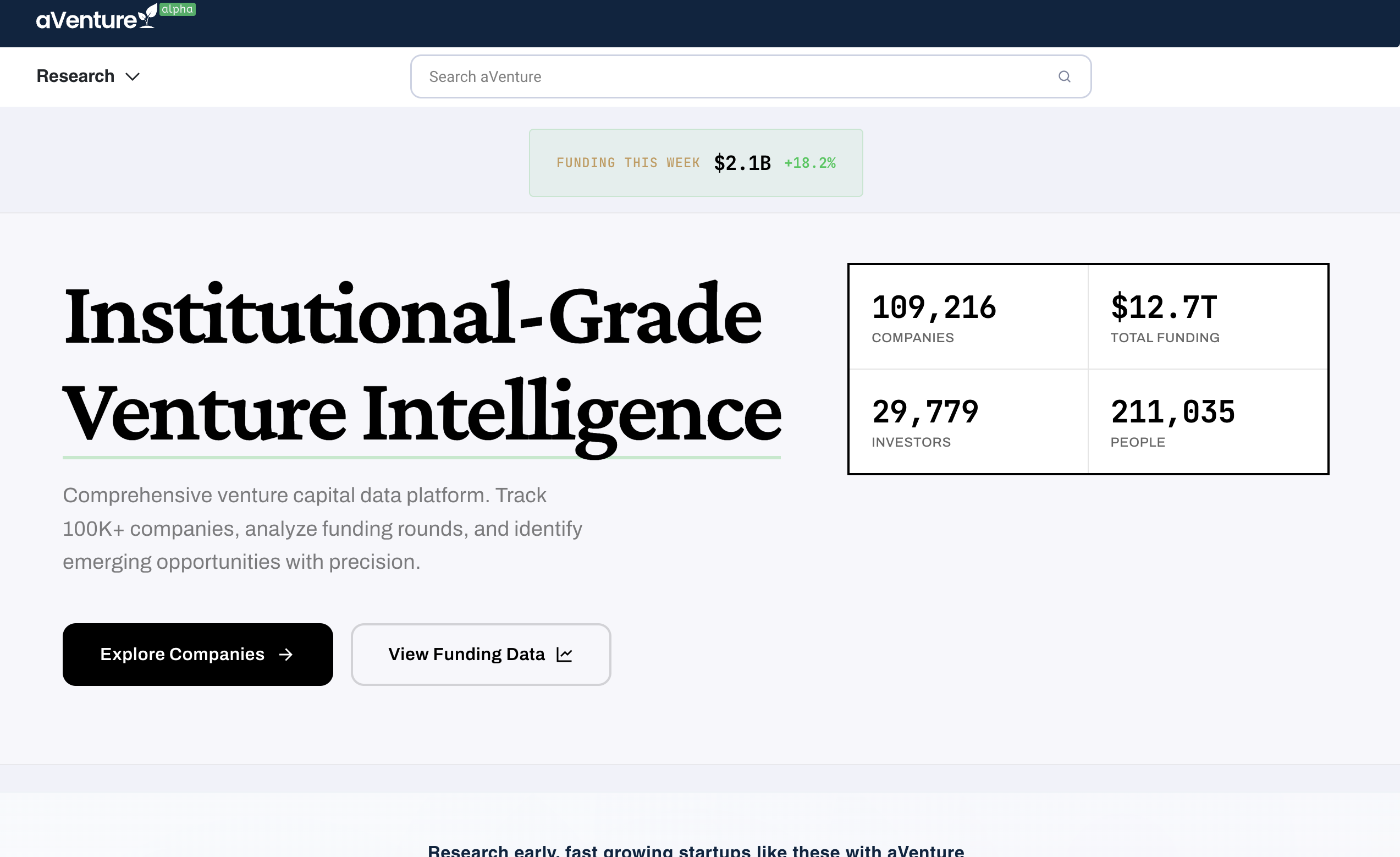

The last decade has seen an explosion of platforms that promise to “democratize” access to private markets — an investing arena once limited to institutions, family offices, and ultra-high-net-worth individuals. Among the newer entrants is aVenture.vc, often simply referred to as aVenture, which markets itself as a venture capital research and insights platform designed to help a broader audience participate in the private-market ecosystem.

But new platforms that straddle the line between fintech, private equity, and investment research naturally raise questions. Many potential users cautiously search for reviews, warnings, or red flags before creating an account. Some even wonder: Is aVenture.vc a scam? Or is it simply a misunderstood, early-stage venture capital tech tool still finding its footing?

This comprehensive review goes deep into aVenture.vc claims, history, risks, structure, and red flags to help readers form a clear and informed opinion. While some online searchers report uncertainty or skepticism toward aVenture, skepticism alone does not equal evidence of fraud. Still, with any investment-related offering, due diligence is not optional — it is essential.

Below is everything you need to know.

1. What Is aVenture.vc Supposed to Be?

At its core, aVenture positions itself as a venture capital research and investing platform. The company markets tools that allow users to:

-

Track a large database of companies

-

Analyze venture capital trends and funding activity

-

Explore investment opportunities shared by partner fund managers

-

Access insights that help investors understand private-market movements

The company publicly states that its mission is to make venture capital knowledge more accessible — and potentially investment access as well, depending on regulatory pathways. Unlike many traditional VC-focused websites, aVenture leans heavily on the promise of data, analytics, and market intelligence, presenting itself as a tech-driven tool rather than merely a fundraising portal.

However, the platform’s dual messaging — implying both research and investment access — has left many potential users confused. Questions naturally arise:

Is this a data product? A venture fund? A marketplace? An investment advisor?

This ambiguity is one of the reasons some individuals feel uncertain or cautious. Lack of clarity can often appear like a red flag, even if the underlying company is legitimate.

2. Indicators That Support Legitimacy

While skepticism is healthy, it is equally important to acknowledge factors that point toward aVenture being a real business rather than a scam operation. Some of these include:

a. A visible corporate footprint

aVenture maintains a company website, public profiles, business listings, and a traceable presence in the startup ecosystem. Scam platforms generally disguise or obscure their identities, often rotating domains or hiding corporate details. aVenture, by contrast, displays standard corporate information and maintains public communication channels.

b. Public launch history

The company announced its launch through conventional channels, complete with mission statements, founder information, platform goals, and future regulatory plans. Scam operations rarely go through the trouble of long-term positioning, and they especially do not announce intentions for compliance or registration.

c. Operating technology and platform uptime

The platform has a functioning dashboard, consistent uptime, and ongoing technical updates — behavior that is not typical of scam websites, which often break, disappear, or change domains frequently.

d. Startup ecosystem affiliations

aVenture has been associated with reputable startup networks and accelerator communities, which suggests it is engaged in standard early-stage company building rather than running a fraudulent operation.

These points don’t eliminate risk — but they do argue against the idea that aVenture is a simple scam website designed to disappear with investor money.

3. Why Some People Suspect a Scam: The Legitimate Concerns

Even if aVenture.vc is not a deliberate scam, there are multiple reasons potential users express doubt or suspicion. These concerns emerge from its business model, messaging, and the nature of private markets in general.

a. A lack of independent reviews

As of this writing, aVenture has little to no user-generated reviews on the major consumer feedback platforms. The absence of verified user experiences makes it difficult to understand whether anyone has successfully used the platform, whether investors have gained access to opportunities, or whether the research tools deliver real value.

b. Confusion about whether actual investments are offered

The company frequently uses language about venture capital access, liquidity, and fund manager relationships. But its publicly accessible website focuses much more on data, insight, and research — not specific offerings.

This creates tension:

-

Some users expect a full venture investing platform

-

Others expect only a research tool

-

The platform itself appears to straddle both worlds

When investment access is advertised or implied but not clearly laid out, users may assume there is something deceptive occurring, even if the issue is simply immature communication.

c. Liquidity promises that might be misunderstood

aVenture.vc has described plans or intentions to enable some form of liquidity or redemption for private-market investments. Experienced investors know that alternative assets like venture capital are inherently illiquid — often locked up for 7–12 years.

Retail investors, however, may interpret any mention of liquidity as a guarantee, setting themselves up for disappointment.

Disappointment is one of the fastest ways people begin labeling something a “scam,” even if no fraudulent behavior occurred.

d. Regulatory ambiguity

aVenture.vc publicly acknowledged that it would need to register or classify itself under relevant investment-adviser frameworks. However, newer platforms often evolve faster than their regulatory filings. When a company is in a gray transition period, people — especially cautious investors — may misinterpret lack of regulatory clarity as something sinister.

e. Newness and lack of track record

The company is young, with limited history, limited funding disclosures, and no long-term performance results. For an investment-related enterprise, the absence of a track record is a natural cause for suspicion.

4. Why Some Users Might Incorrectly Call It a Scam

To understand the controversy, it helps to analyze why misunderstandings arise. Here are the most common reasons:

a. Misalignment between expectations and reality

New retail investors often expect venture investing to resemble stock investing:

-

Fast liquidity

-

Easy exits

-

Frequent updates

-

Clear valuations

Private markets simply aren’t built this way. When users discover this after reading marketing language about liquidity or access, they may incorrectly assume deception.

b. Lack of clarity about what the platform truly offers

aVenture.vc markets itself as a tool for investors — but the exact nature of that tool isn’t always obvious from the outside. When positioning lacks precision, users fill the gaps with their own assumptions. If those assumptions are unmet, they may complain, even if the business never promised what they imagined.

c. High-risk category

Anything involving private investments or venture capital is automatically riskier, more volatile, and more complex than traditional investing. Platforms in this sector often get called “scams” even when they are legitimate simply because users do not fully understand private-market dynamics.

d. Confusion with similarly named companies

Other companies with similar names — often unrelated businesses — have been flagged on scam-awareness platforms. This creates spillover suspicion, even though those red flags do not apply to aVenture.vc specifically.

5. Comparison to More Established Private-Market Platforms

To understand where aVenture.vc stands, it helps to compare it to more established platforms such as:

-

Large equity-crowdfunding websites

-

Broker-dealer backed secondary marketplaces

-

Regulated venture investment portals

-

Global tech-startup investment platforms

These platforms typically provide:

-

Documented track records

-

Full regulatory compliance

-

Visible investment vehicles

-

User testimonials and case studies

In contrast, aVenture.vc appears to be more of a research-driven platform that may eventually bridge users to investment opportunities, rather than a fully formed broker-dealer marketplace.

This difference is crucial. Some users approach aVenture expecting a hands-on investment portal — and when they do not see familiar investment infrastructure, they grow suspicious.

6. Risks to Be Aware of Before Using aVenture.vc

Regardless of whether a platform is a scam, every investor must understand the risks. Here are the major concerns related to aVenture:

a. Illiquidity of private markets

Even if the platform eventually offers partial liquidity, this is not the same as the near-instant selling you see in public markets.

b. Regulatory uncertainty

If the platform is still in the process of registration or classification, users must be prepared for evolving disclosures and shifting legal frameworks.

c. Early-stage startup risk

Platforms that are still raising capital or building products face survival risk. If a company fails or pivots, users could find themselves without support for tools they rely on.

d. Limited transparency into underlying investment opportunities

If investment access is offered indirectly through partner fund managers, users may have limited visibility into the actual assets.

e. Misinterpretation risk

Users must understand the difference between research/tooling platforms and regulated investment platforms. Confusion often leads to negative experiences, even absent wrongdoing.

7. Who Might Actually Benefit From aVenture.vc ?

Despite risk factors and concerns, there is a specific set of users who may still find legitimate value in aVenture:

-

Sophisticated retail investors who understand the nature of private markets

-

Tech founders tracking VC activity

-

Independent analysts and emerging fund managers looking for datasets

-

New investors seeking educational exposure to venture investing trends

If the platform’s primary value is its data — rather than direct investing — then users seeking insights rather than transactions may find it useful.

8. Final Verdict: Is aVenture.vc a Scam?

Based on the information available:

aVenture.vc does not appear to be a scam

There is no persuasive evidence of fraudulent activity, no reports of stolen funds, and no signs of the classic hallmarks of scam websites. The platform presents itself as a legitimate early-stage fintech company building venture-capital research tools with potential future investing functionality.

However:

It is a high-risk platform in a high-risk industry

And many of the concerns people raise — lack of reviews, unclear offerings, regulatory ambiguity, and liquidity expectations — stem from genuine structural issues in the private-market ecosystem.

In other words:

-

Not a scam

—but— -

Not risk-free

-

Not well-understood

-

Not clearly defined in its public messaging

Potential users should approach aVenture.vc the same way they would approach any early-stage fintech operating in the private-investment world: cautiously, curiously, and with a clear understanding of the limitations of such platforms.

9. How To Protect Yourself When Using New Investment-Adjacent Platforms

If you plan to explore aVenture.vc or any similar platform, here are important safety steps:

-

Read all documentation, terms, and disclaimers

-

Understand the difference between data platforms and investment platforms

-

Start with minimal engagement before committing resources

-

Verify regulatory statuses once publicly available

-

Maintain realistic expectations about private-market liquidity

These precautions are universal — not specific to aVenture — and apply to any venture-capital or private-market tool.

Conclusion

aVenture.vc occupies a gray but increasingly common space in the modern investment landscape: a tech-first platform attempting to lower the informational barriers to venture capital. Its lack of user reviews, vague messaging, and newness naturally raise concerns, leading some individuals to question its legitimacy. However, there is no concrete evidence at this time that it is a scam.

Instead, the platform appears to be an ambitious but early-stage venture that requires cautious engagement and realistic expectations. As with all private-market tools, the burden of due diligence remains firmly on the user — and those who understand the risks may find value in its research-driven approach.

Report aVenture.vc Scam and Recover Your Funds

If you have lost money to aVenture.vc, it’s important to take action immediately. Report the scam to LOSTFUNDSRECOBERY.COM, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like aVenture.vc continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud. Read More reviews at Scams2Avoid