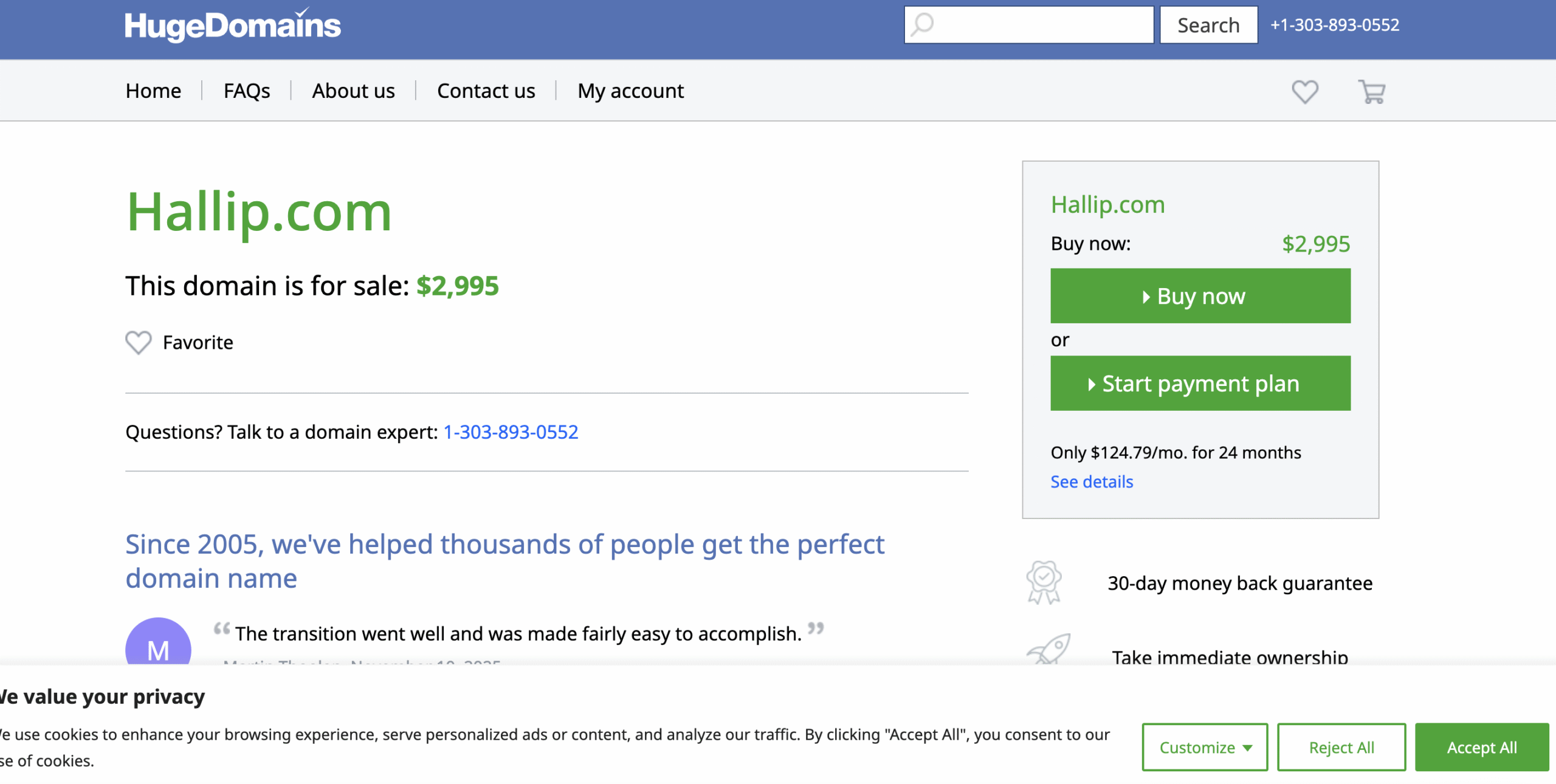

In the ever-expanding world of online trading, thousands of platforms compete for the attention—and money—of new traders. While some trading platforms are legitimate and well-regulated, many others deliberately operate in the shadows, using deceptive marketing tactics to lure unsuspecting investors into fraudulent schemes. One such platform surrounded by red flags is Hallip.com. Numerous traders and industry reviewers have raised concerns that Hallip operates more like a classic online trading scam than a trustworthy broker.

This in-depth review breaks down the many red flags surrounding Hallip.com, explains how these scams typically operate, and details why traders should exercise extreme caution when interacting with platforms that display the characteristics seen here.

1. What Exactly Is Hallip.com?

Hallip.com advertises itself as an online brokerage offering trading services in forex and possibly other financial instruments. At first glance, the website appears to be professionally designed. It uses familiar regulatory logos, polished marketing language, and a structure meant to reassure potential clients that it is a sophisticated and globally compliant trading platform.

However, once you dig beneath the surface, troubling inconsistencies appear. The platform is extremely vague about:

-

The actual company running Hallip

-

The physical location of the business

-

Ownership details

-

Licensing and corporate registration

-

Real contact information

-

Legal disclosures normally required of financial institutions

Legitimate brokers prominently display their regulatory credentials, physical address, company registration, and legal disclosures. When a platform is almost completely opaque—like Hallip.com—it’s a significant early warning sign.

2. The Regulation Problem: False Claims and Fabricated Legitimacy

One of the clearest indicators of a scam brokerage is false regulation claims, and Hallip.com displays this red flag repeatedly.

2.1 Fake or Unverifiable License Numbers

Hallip.com claims regulation under well-known authorities such as CySEC or offshore financial authorities. However:

-

The license numbers do not match any known licensed broker.

-

The regulatory bodies they reference do not list Hallip as an authorized provider.

-

The platform provides no verifiable documentation of licensing.

When a broker claims regulation but cannot produce evidence—and public records contradict the claim—it is a near-certain indicator of a fraudulent operation.

2.2 Inconsistent Leverage Rules

Hallip.com also displays major inconsistencies in its leverage information. Some parts of the site state leverage from 1:20 to 1:100, while other sections mention extreme leverage up to 1:1000. This inconsistency is highly suspicious for several reasons:

-

Regulated brokers must cap leverage and follow strict rules.

-

Leverage changing across the website suggests a lack of regulatory oversight.

-

Extremely high leverage is dangerous for traders and often a sign of a scam enticing users with big returns.

These contradictions point to a platform unconcerned with compliance and transparency.

3. Protection of Client Funds: A Massive Red Flag

Legitimate financial brokers are required to follow strict rules designed to protect client funds. Hallip.com shows no evidence of following any of these rules.

3.1 No Segregated Accounts

Segregated accounts ensure that client funds are kept separate from the company’s operating money. This protects traders in case the company faces financial trouble. Hallip provides no indication of using segregated accounts.

3.2 No Negative Balance Protection

Negative balance protection prevents traders from owing more money than they deposited. Hallip does not offer this protection, meaning a trader could theoretically wind up in debt to the platform. Reputable brokers widely offer this safeguard.

3.3 High Minimum Deposit

Hallip.com reportedly requires a minimum deposit of $1,000, which is unusually high—especially for an unproven platform.

Scam brokers often demand high initial deposits to extract maximum value from victims before disappearing.

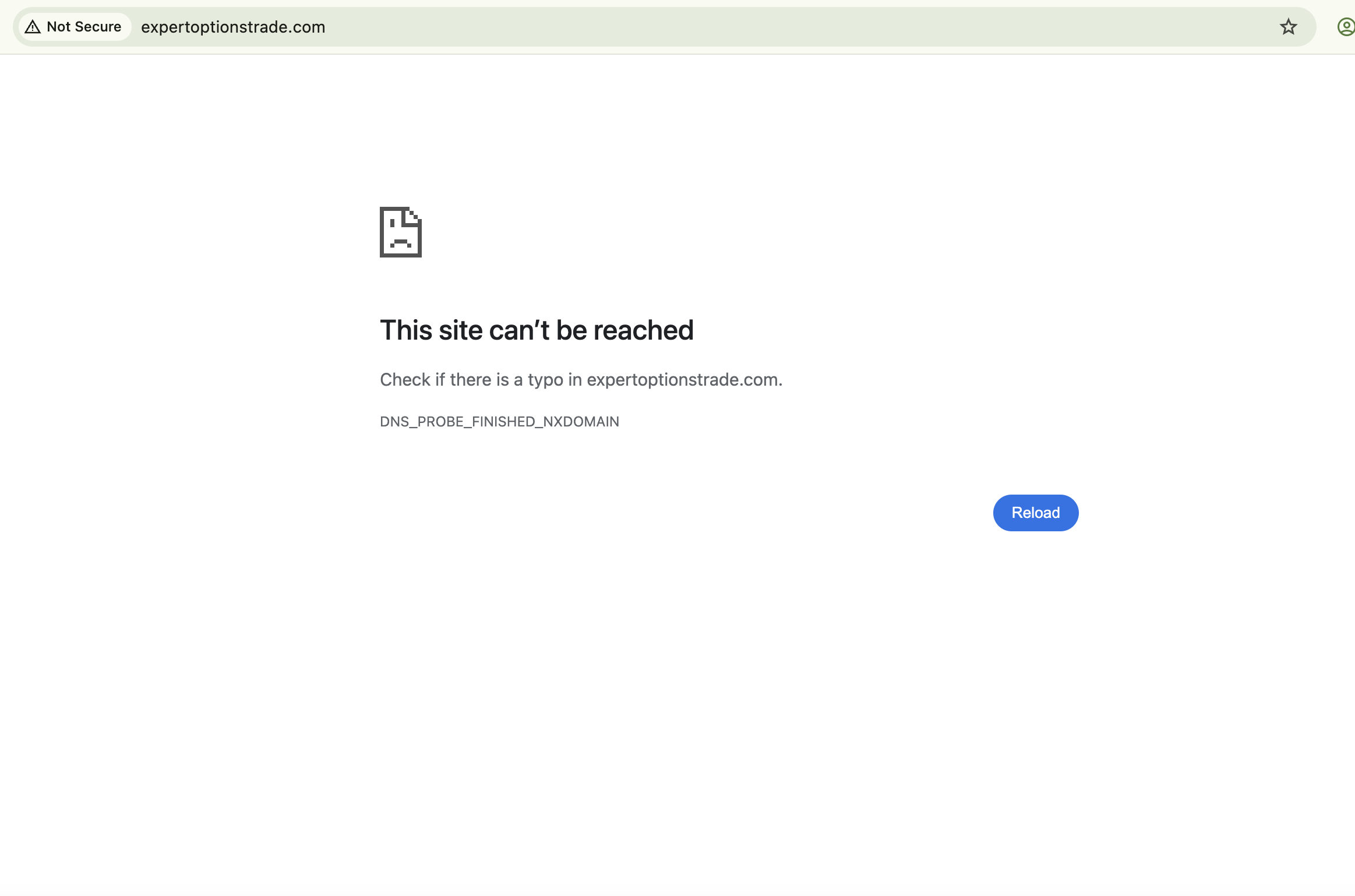

4. Trading Platform Issues: Does a Real Platform Even Exist?

One of the most alarming signals is that Hallip.com may not offer a real, functioning trading platform at all.

Reviewers have reported:

-

No clear or accessible download link for a trading platform

-

No detailed explanation of what platform they use (MT4, MT5, web trading interface, etc.)

-

Login errors when attempting to access supposed trading areas

-

No platform screenshots or demonstrations

-

No technical documentation about the platform

For a supposed financial intermediary, failing to provide any tangible proof of a trading platform is a major red flag. Scam brokers commonly create fake dashboards or non-functional interfaces designed solely to trick investors into believing their money is being traded.

5. Questionable Trading Conditions and Hidden Rules

Scam brokers often entice traders with attractive conditions, only to trap them with sudden fees, undisclosed restrictions, and manipulative account rules later.

5.1 Conflicting Information

Hallip’s website displays:

-

Conflicting leverage details

-

Vague spread and fee structures

-

No transparent explanation of withdrawal procedures

-

No published terms regarding slippage, commissions, rollover fees, or margin rules

When a broker hides or contradicts basic trading information, it is typically because transparency would reveal the scam.

5.2 Withholding Withdrawal Information

Scam brokers often avoid giving clear withdrawal information because allowing easy withdrawals is bad for business—once the money leaves their system, they lose control over the funds.

Hallip.com provides no reliable information about:

-

Withdrawal fees

-

Processing times

-

Documentation requirements

-

Withdrawal limits

-

Withdrawal methods

This lack of transparency is one of the biggest danger signs.

6. Trust and Reputation: A Troubling Online Footprint

The online reputation of Hallip.com is deeply concerning.

6.1 Sparse or Negative User Reviews

There are very few credible user reviews for Hallip.com, and the ones that do exist are overwhelmingly negative. Complaints commonly include:

-

Traders unable to withdraw their money

-

Accounts suddenly freezing

-

Funds disappearing from trading dashboards

-

Customer service ignoring messages or calls

-

False promises of high returns from “account managers”

A legitimate broker—even a new one—should have a transparent, traceable reputation across multiple platforms.

6.2 Professional Reviewers Labeling It a Scam

Multiple expert reviewers in the trading industry have stated outright that Hallip.com displays nearly every characteristic of a scam broker. These reviewers cite issues like:

-

Fake regulation

-

No trading platform

-

Opaque ownership

-

Misleading marketing

-

High minimum deposits

-

Sudden account freezes

It is extremely rare for multiple independent reviewers to unanimously warn against a broker unless substantial red flags exist.

7. How Hallip.com Likely Operates as a Scam

By analyzing common patterns in online brokerage scams and comparing them to Hallip’s behavior, a likely fraud model emerges.

7.1 Step 1: Attracting Victims

Hallip.com uses:

-

Attractive but vague promises

-

Fake regulatory claims

-

Professional-looking websites

-

High leverage promises

-

“Account manager” persuasion tactics

These methods lure inexperienced traders into depositing money quickly, without due diligence.

7.2 Step 2: Manipulating the Trading Dashboard

Scam brokers often use fake numbers on their dashboards to make customers believe:

-

They’re earning profits

-

Their trades are growing

-

Their account balance is rising

Since Hallip.com provides no verified platform, there is a strong possibility that any displayed balances are fictitious.

7.3 Step 3: Blocking Withdrawals

Once traders attempt to withdraw funds, the platform may:

-

Delay the request

-

Claim missing documents

-

Demand additional deposits

-

Lock the account

-

Stop responding

This is the hallmark of a classic investment scam.

7.4 Step 4: Disappearing or Rebranding

Many scam brokers simply shut down and reappear under a new name once enough complaints accumulate.

Because Hallip.com provides almost no verifiable corporate details, disappearing without accountability would be easy.

8. If You’re Considering Hallip.com: What You Must Know

Before depositing money with any online broker, especially one with red flags like Hallip.com, you must take critical precautions.

Key Questions to Ask:

-

Is the broker verifiably regulated?

-

Is a real company name and address provided?

-

Can I verify their license?

-

Does the broker provide platform access before depositing?

-

Is the minimum deposit unusually high?

-

Are withdrawals straightforward, documented, and tested by real users?

If the answer to any of these is unclear or negative, avoid the broker.

9. If You Already Deposited Money

If you already invested with Hallip.com and have concerns, consider taking the following actions:

-

Document every interaction and transaction

-

Contact the platform and request a formal withdrawal

-

Notify your bank or payment provider about the situation

-

File formal complaints with relevant financial authorities

-

Warn others by sharing your experience in public forums

Taking early action is important because the longer the scam continues, the harder it becomes to track funds.

10. Why Platforms Like Hallip.com Continue to Thrive

Scam brokers like Hallip.com continue to operate because:

-

Setting up a fake brokerage website is cheap

-

They target inexperienced traders

-

Many victims deposit without researching regulation

-

They can operate offshore with little oversight

-

They can shut down and restart under a new name

-

They rely on psychological manipulation and high-pressure tactics

Understanding these mechanics is crucial for protecting yourself from similar schemes.

11. Final Verdict: Is Hallip.com a Scam?

Based on all available evidence, Hallip.com displays nearly every major characteristic of an online trading scam:

-

Fake regulatory claims

-

No working trading platform

-

No evidence of client fund protection

-

Opaque company structure

-

High minimum deposit

-

Negative trader experiences

-

Inconsistent or false information on its website

-

Lack of transparency in fees and withdrawals

Every red flag points in the same direction: Hallip.com is overwhelmingly likely to be a fraudulent platform designed to extract deposits from unsuspecting traders, not a legitimate brokerage.

12. Final Advice: Protect Yourself

If you value your financial security:

-

Avoid Hallip.com entirely

-

Only trade with brokers that are verifiably licensed

-

Research any platform thoroughly before depositing

-

Stay skeptical of high-pressure tactics and too-good-to-be-true promises

-

Double-check regulation directly with official financial authorities

Your money and personal information deserve better than the risks presented by platforms like Hallip.com.

Report Hallip.com Scam and Recover Your Funds

If you have lost money to Hallip.com, it’s important to take action immediately. Report the scam to LOSTFUNDSRECOBERY.COM, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Hallip.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud. Read More reviews at Scams2Avoid