Introduction

In today’s digital age, financial scams are becoming more sophisticated, often hiding behind the façade of legitimate-looking websites. Many individuals searching for loans or mortgage refinancing online encounter platforms that promise the best rates, fast approval, and “no-obligation” simulations — only to discover later that these offers were misleading or fraudulent.

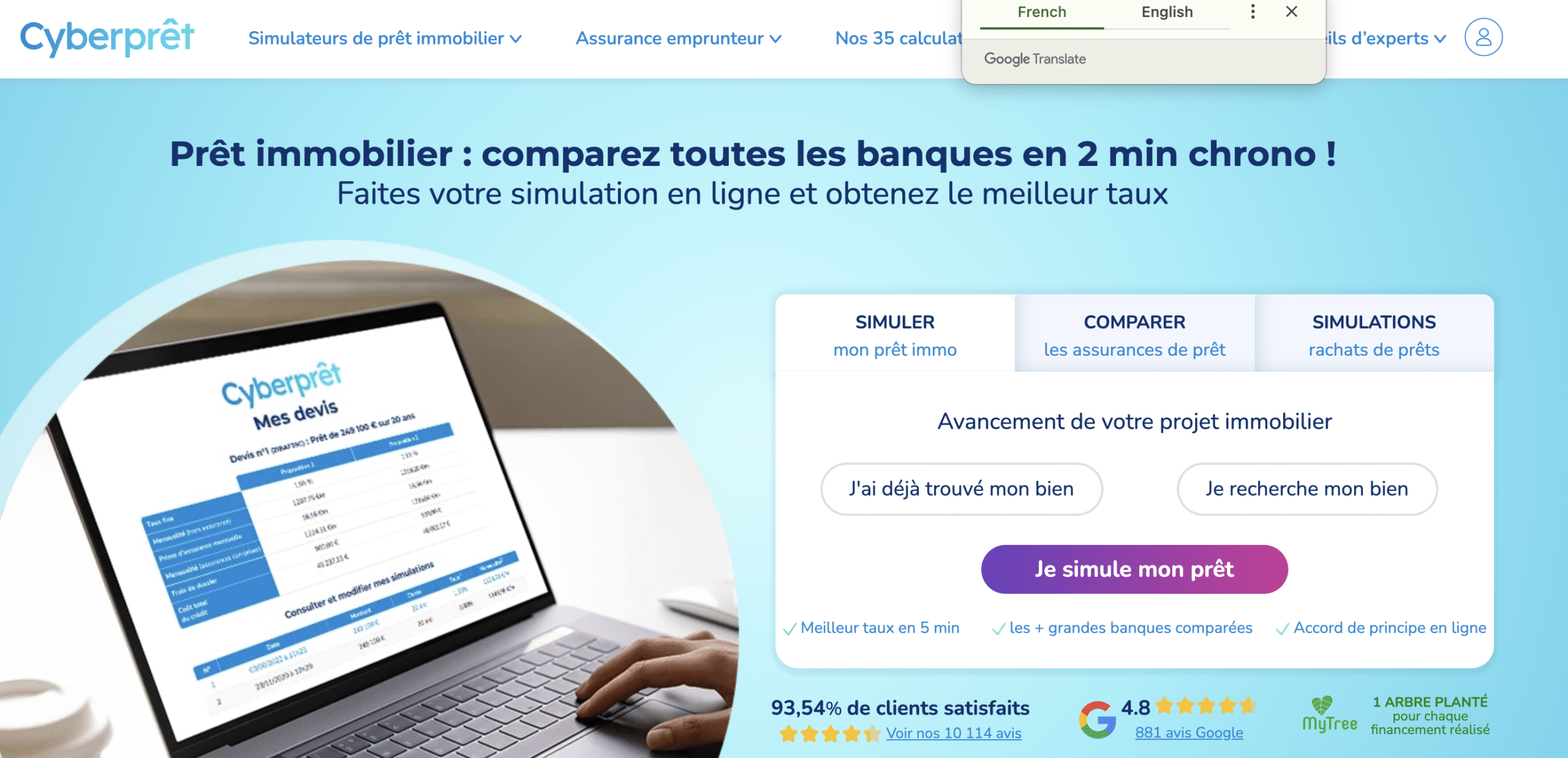

One platform currently under scrutiny is CyberPret.com, which markets itself as a French mortgage and loan brokerage. At first glance, it appears professional and trustworthy: the site claims long-standing experience, thousands of satisfied clients, and partnerships with dozens of lending institutions. However, a closer look reveals a web of inconsistencies, questionable practices, and troubling reviews that raise red flags about the site’s legitimacy.

This in-depth review examines CyberPret.com from multiple angles — how it presents itself, the warning signs that point to a possible scam, user feedback, and the credibility of its operations.

What CyberPret Claims to Offer

CyberPret.com describes itself as a mortgage broker specializing in real-estate loans and refinancing. The company claims to:

-

Find the best mortgage rate from a network of over 80 financial institutions.

-

Offer free, no-commitment loan simulations.

-

Provide fast approvals and expert support from experienced advisors.

-

Deliver a “93.5% satisfaction rate” and thousands of positive client reviews.

The homepage emphasizes professionalism, with phrases like “Votre satisfaction : notre priorité !” (“Your satisfaction: our priority!”) and boasts impressive figures such as 10,000+ satisfied clients and a 4.8/5 Google rating. The overall presentation is sleek and credible, designed to win the trust of users quickly.

But surface-level polish can often mask deeper problems. Once users begin interacting with the platform, the experience reportedly shifts dramatically.

Why CyberPret Appears Suspicious

Several concerning factors undermine the credibility of CyberPret.com. While the company’s marketing language paints a picture of reliability and expertise, its actual track record and online footprint suggest otherwise.

1. Inflated and Unverifiable Reviews

CyberPret proudly displays claims of having over 10,000 customer reviews and an average satisfaction rate above 90%. However, independent platforms show a completely different picture. Only a handful of real reviews exist, and many of them are negative.

The contrast between the enormous number of supposed testimonials on the company’s website and the small number available through independent channels is a major red flag. Scam operations often use fake testimonials or inflated numbers to create an illusion of credibility.

2. Poor Customer Experiences

Multiple individuals have reported serious problems when dealing with CyberPret. Some common complaints include:

-

Lack of response after submitting personal and financial documents.

-

Repeated requests for additional paperwork followed by silence.

-

Promises of “guaranteed approval” that never materialize.

-

Advisors who become unreachable once a client shows interest.

These complaints indicate that the platform might be more interested in collecting personal data or appearing legitimate than in actually helping clients obtain loans.

3. Missing Regulatory Information

Any company acting as a mortgage or credit broker in France must be registered with the proper regulatory bodies and have an identifiable business license. A legitimate broker usually provides clear legal details, including registration numbers, professional indemnity insurance, and contact information for compliance departments.

CyberPret.com offers no verifiable regulatory or licensing data. The absence of official registration details makes it impossible to confirm that it operates under the supervision of relevant French financial authorities. For a company claiming to manage sensitive financial data, this omission is deeply troubling.

4. Hidden Ownership

The website’s domain registration hides the owner’s identity. While not illegal, anonymity in financial services is a major warning sign. Genuine financial institutions are transparent about their leadership and company structure. A hidden domain owner suggests an attempt to avoid accountability — a tactic frequently seen in fraudulent operations.

5. Unrealistic Marketing Claims

CyberPret advertises partnerships with dozens of major banks and lenders. Yet, there is no concrete evidence of any official collaboration. None of the claimed partner institutions publicly confirm these relationships.

The company’s promise to “find the best rate among 85 lenders” also appears exaggerated. Real brokers disclose the specific banks they work with and provide examples of interest rates or loan conditions. CyberPret offers none of this transparency, relying instead on vague assurances.

6. Declining Online Activity

The website’s online traffic has reportedly fallen sharply over the past year. While that alone doesn’t prove fraud, such a decline often indicates customer dissatisfaction or loss of public trust. Many scam-like platforms show a similar pattern — heavy promotion at first, followed by a rapid drop once users begin sharing negative experiences.

Patterns Typical of Scam Operations

When analyzing CyberPret’s behavior, it becomes clear that its business model follows several patterns seen in fraudulent online lending schemes:

-

Attractive promises with minimal verification: CyberPret entices users with free simulations and unbeatable rates, encouraging them to submit personal data immediately.

-

Data collection disguised as service: Users are asked to upload sensitive documents — identification, income proof, and banking information — early in the process.

-

Lack of follow-through: After receiving these details, many clients report that communication stops or becomes inconsistent.

-

Fabricated credibility: The site uses high satisfaction figures and “verified” client quotes that can’t be independently traced.

-

Absence of professional oversight: Without regulatory registration, there is no authority to hold the company accountable for misconduct.

These traits align closely with the anatomy of a classic online financial scam — one that doesn’t necessarily steal money upfront, but instead harvests personal data or leads for resale to other questionable entities.

The Risk of Personal Data Exploitation

Perhaps the most serious danger associated with platforms like CyberPret is not financial loss through direct payments, but identity and data theft.

When users upload sensitive documents — such as payslips, ID cards, tax records, and bank statements — they provide everything a criminal operation would need to impersonate them. Such data can be used to open fraudulent accounts, apply for loans in the victim’s name, or be sold to third parties on the dark web.

Even if CyberPret is not directly engaging in data theft, its lack of transparency and unclear data-handling policies create unacceptable exposure for users. Any legitimate mortgage broker must clearly explain how personal information is stored, encrypted, and shared. CyberPret does none of this convincingly.

A Closer Look at User Sentiment

Publicly available feedback paints a mixed but worrying picture. Some customers claim satisfactory experiences, describing polite representatives and helpful advice. However, the majority of detailed reviews express frustration and distrust.

Common patterns among the dissatisfied include:

-

“They asked for every document imaginable and then disappeared.”

-

“I was promised approval in days; it’s been months with no answer.”

-

“Their advertised rates are fake — no real offers came through.”

-

“Communication stopped as soon as I asked for regulatory proof.”

The consistency of these complaints suggests systemic issues rather than isolated incidents. Even if CyberPret.comonce operated legitimately, it now appears to function with little to no regard for customer follow-through or transparency.

Comparing CyberPret.com to Legitimate Brokers

To understand why CyberPret.com’s practices are so concerning, it helps to compare them with how a real, reputable mortgage broker operates.

| Feature | Legitimate Broker | CyberPret.com |

|---|---|---|

| Regulatory registration | Publicly listed with relevant authorities | None publicly confirmed |

| Transparency | Clear company ownership and contact information | Owner hidden |

| Reviews | Verifiable, spread across multiple platforms | Inflated and inconsistent |

| Data protection | Detailed privacy and security policies | Vague or missing |

| Customer feedback | Balanced, with resolved complaints | Numerous unresolved complaints |

| Business longevity | Stable reputation growth | Declining visibility and trust |

This comparison underscores the many discrepancies between CyberPret and authentic financial intermediaries.

The Psychological Strategy Behind the Scam

CyberPret.com’s website is designed to disarm visitors through professional design and emotional appeal. The site’s tone focuses on reassurance — “your satisfaction is our priority,” “no commitment,” and “trusted by thousands.” These are carefully chosen phrases that lower skepticism and encourage users to share information quickly.

Additionally, the simulated “loan calculator” acts as a psychological hook. Users input personal financial data believing they’re about to receive a realistic rate. In reality, this may serve as the platform’s mechanism to collect personal and contact information for marketing or illicit resale purposes.

This strategy preys on urgency, trust, and hope — key psychological triggers that scammers exploit to extract valuable information before users have time to investigate legitimacy.

The Broader Context: Rise of Fake Financial Brokers

CyberPret.comt is not unique in its approach. Over the past few years, numerous similar websites have appeared across Europe, posing as mortgage consultants, investment advisors, or insurance comparison platforms. Many of these sites share common characteristics:

-

Professionally designed landing pages with fake testimonials.

-

Claims of long histories despite recently registered domains.

-

Hidden ownership details.

-

Requests for personal or banking information.

These operations often target French-speaking markets where online lending regulations are less familiar to consumers. The goal is to appear local and legitimate while harvesting data or upfront “processing fees.”

CyberPret.com fits this pattern almost perfectly, making it part of a growing ecosystem of deceptive financial platforms.

The Cost of Trusting the Wrong Platform

Engaging with a dubious financial service can have lasting consequences. Beyond potential financial loss, the psychological and administrative toll can be immense. Victims often spend months attempting to trace their information, secure their identities, and undo the damage.

Even when money isn’t stolen directly, users who share documents may experience fraudulent credit inquiries or receive suspicious financial offers from third-party companies. The potential misuse of sensitive data is reason enough to approach such websites with extreme caution.

Why the Red Flags Can’t Be Ignored

Individually, some of CyberPret.com’s issues might seem like typical business shortcomings — poor communication or slow service, for example. But when all the warning signs appear together — inflated claims, hidden ownership, lack of regulation, unverified testimonials, and customer ghosting — the cumulative picture becomes unmistakably alarming.

These are not signs of a legitimate but struggling company; they are hallmarks of a high-risk, potentially deceptive operation.

Practical Advice Before Using Any Online Loan Broker

To protect yourself from schemes like CyberPret.com, it’s essential to follow best practices whenever you deal with online financial intermediaries:

-

Verify licenses and registrations before sharing any personal or financial information.

-

Avoid websites that boast huge satisfaction rates without verifiable external reviews.

-

Never send sensitive documents to unverified companies.

-

Use trusted channels — your own bank, officially recognized brokers, or government-approved platforms.

-

Be skeptical of promises that sound too good to be true.

Conclusion

CyberPret.com may present itself as a modern, efficient, and client-focused mortgage broker, but the overwhelming evidence points to something far less trustworthy. The combination of unverifiable claims, hidden ownership, regulatory ambiguity, and recurring customer complaints suggests that this platform operates in a grey or outright deceptive zone.

While not every user may have been outright defrauded, the risk level associated with CyberPret is unacceptably high. Its methods mirror those of known online financial scams — promising easy access to credit, collecting private data, and then failing to deliver.

In the end, the safest course is simple: avoid CyberPret.com entirely. Seek financing through transparent, regulated, and well-reviewed institutions. When your financial future is at stake, trust should never be given lightly — and CyberPret has done little to earn it.

Report CyberPret.com Scam and Recover Your Funds

If you have lost money to CyberPret.com , it’s important to take action immediately. Report the scam to LOSTFUNDSRECOBERY.COM, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like CyberPret.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud. Read More reviews at Scams2Avoid