Disclaimer: This article is for educational purposes only.

Stepping into the World of Online Investments

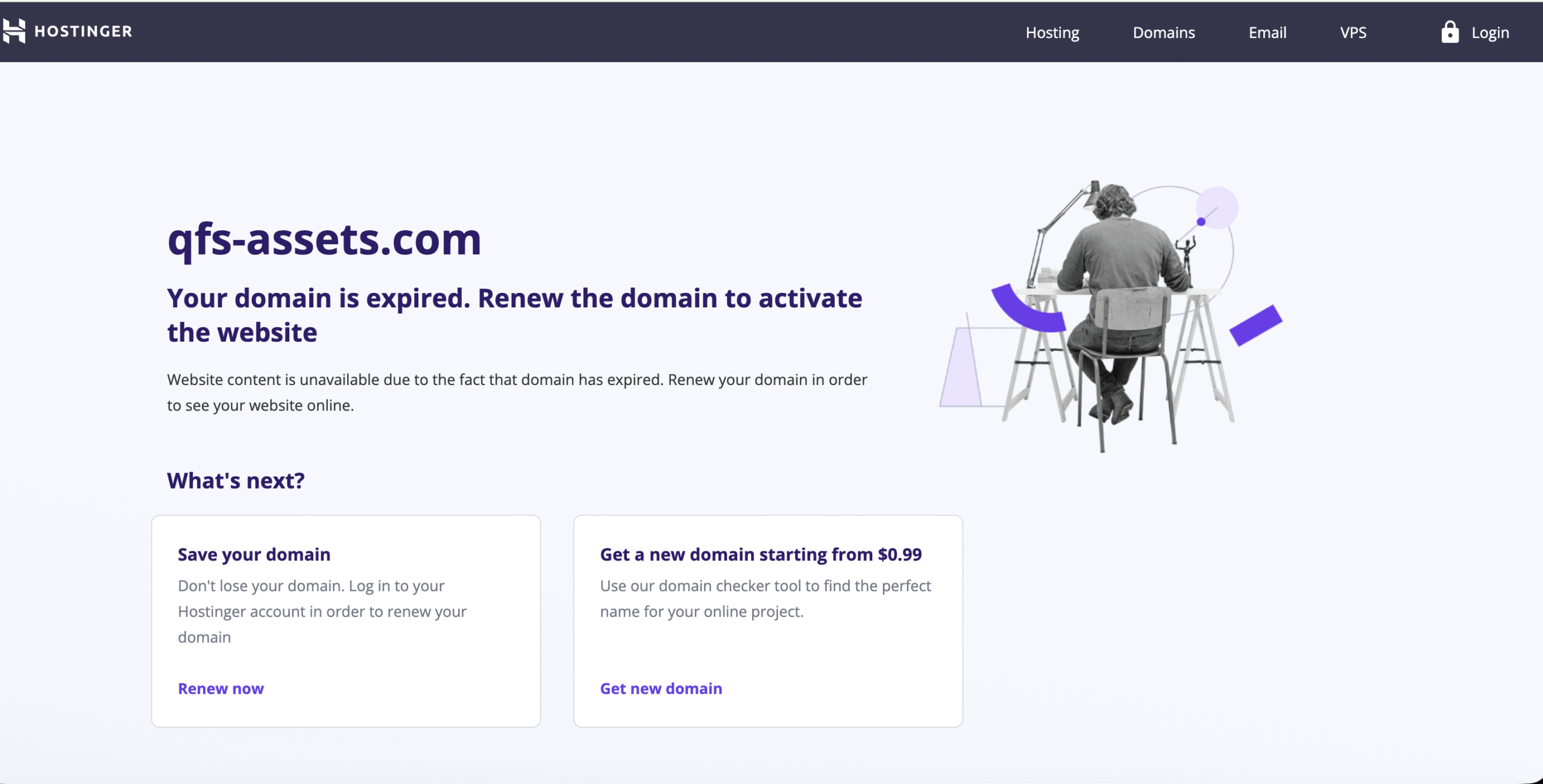

Online investment platforms can be tempting. Slick websites, promises of high returns, and “exclusive strategies” lure beginners and experienced investors alike. QFS Assets — available at qfs-assets.com — has recently caught attention, but not always for good reasons. While qfs-assets.com presents itself as a professional asset management service, multiple signals suggest that caution is necessary.

What QFS Assets Claims

According to its website, QFS Assets promises:

Asset security and management for long-term growth

Exclusive investment strategies

Sophisticated tools to optimize returns

On the surface, it looks impressive. However, promotional language doesn’t always equal legitimacy. Several practical red flags make the platform worth scrutinizing before considering any deposits.

6 Key Risks Associated with QFS Assets

1. No Verifiable Regulation

A legitimate investment firm operates under regulatory oversight. QFS Assets provides no verifiable licensing or registration details. Without regulation, investor funds are not legally protected, and there’s no guarantee of fair operations.2. Hidden Ownership and Young Domain

The qfs-assets.com domain is new, and ownership details are masked. Low reputation scores and minimal third-party references suggest the platform hasn’t built trust organically — a common feature of high-risk sites.3. Scarce and Negative User Feedback

Independent reviews are rare, but the ones that exist raise concerns. Complaints often mention missing funds, unresponsive support, or misleading promises. Lack of transparency in user experiences is a warning sign in itself.4. Aggressive Marketing and Unrealistic Promises

QFS Assets advertises rapid financial growth and “exclusive” opportunities. Marketing that emphasizes high returns with minimal risk is a classic lure used by risky or fraudulent platforms.5. Withdrawal Difficulties

One of the most consistent issues reported by users of similar platforms is the inability to access funds. Delays, extra fees, or blocked withdrawals are red flags that indicate potential problems.6. Similarity to Known Scam Models

Patterns such as anonymous ownership, crypto-only deposits, young domains, and high-pressure marketing align closely with previously exposed scams. This doesn’t guarantee fraud, but it strongly elevates risk.

Why Investors Fall for Platforms Like QFS Assets

Many investors are attracted by:

Promises of high returns

Fear of missing out (FOMO) on “exclusive” opportunities

Technical-sounding jargon that creates an illusion of expertise

Social media ads or messaging campaigns targeting beginners

Even experienced investors can be caught off guard when a platform seems professional and sophisticated.

Read More Related Articles- [AkashX.com Exposed]

What to Do if You’ve Invested

If you’ve already deposited funds on QFS Assets:

Stop all further deposits immediately.

Document everything — take screenshots, keep emails, and record transaction logs.

Check with your payment provider — banks and card companies may assist in disputes.

Report the incident — platforms like LOSTFUNDSRECOVERY.COM can guide you in documenting and recovering funds.

Share your experience — alerting others can prevent additional losses.

Quick action increases the chances of protecting your assets.

Broader Lessons for Online Investments

Always verify regulation and licensing before investing.

Check the domain age and ownership transparency of platforms.

Be wary of unsolicited offers through social media or messaging.

Avoid platforms that demand crypto deposits with promises of guaranteed returns.

Investigate withdrawal procedures — difficulty accessing funds is a major red flag.

Final Verdict

QFS Assets (qfs-assets.com) shows multiple signs of a high-risk investment platform:

Young domain and hidden ownership

Extremely low reputation scores

Minimal and negative user feedback

No verifiable regulation

Aggressive marketing with promises of high returns

Until the platform provides transparent company details, audited results, and regulatory verification, it cannot be considered trustworthy.

For anyone interacting with QFS Assets, caution is crucial — and using verified, regulated investment platforms remains the safest path.

Take Action and Protect Your Funds

If you’ve been affected by QFS Assets, LOSTFUNDSRECOVERY.COM provides a safe channel to report incidents and explore possible recovery options. Acting quickly and documenting everything can prevent further losses and help hold untrustworthy platforms accountable.

Stay informed, stay cautious, and prioritize platforms with transparency, regulation, and a verifiable track record.

Internal Links

- Learn crucial protection strategies our – Scam Recovery Guide

- Evaluate platforms properly by reading on how to Verify Platforms

- Read about the Most Common Online Scam Tactics here- Scam Tactics

- Secure your digital assets with the Crypto Safety Guide

- Spot dangerous websites using Fake Website Warning Signs

- Learn What to Do After Being Scammed- Recovery Steps

Follow Us On:

- 128 City Road, London, UK, EC1V 2NX

- Mon – Fri: 8 AM – 6 PM

- contact@lostfundsrecovery.com