Investico.com Reviews 2025 : Detailed Exposé

In the booming world of online trading and investment platforms, new players emerge constantly. Some are legitimate; others are not. Over recent months, the platform Investico.com has drawn alarmingly negative feedback from users, combined with low ratings from trust‑scoring services. This has triggered concerns that Investico.com may be operating as a scam or at least highly risky. In this article we dive deeply into the evidence, the red flags, what people are reporting, and why you should think twice before investing.

Online trading platforms rely on trust architecture as much as technology. Interfaces, account rules, communication timing, and withdrawal pathways quietly shape whether users feel empowered or constrained. When those elements fail to align, friction appears — not as a single incident, but as a pattern that gradually alters user control.

This review examines how Investico.com functions in practice, not by labeling outcomes, but by tracing where reported user experiences diverge from what the platform presents operationally.

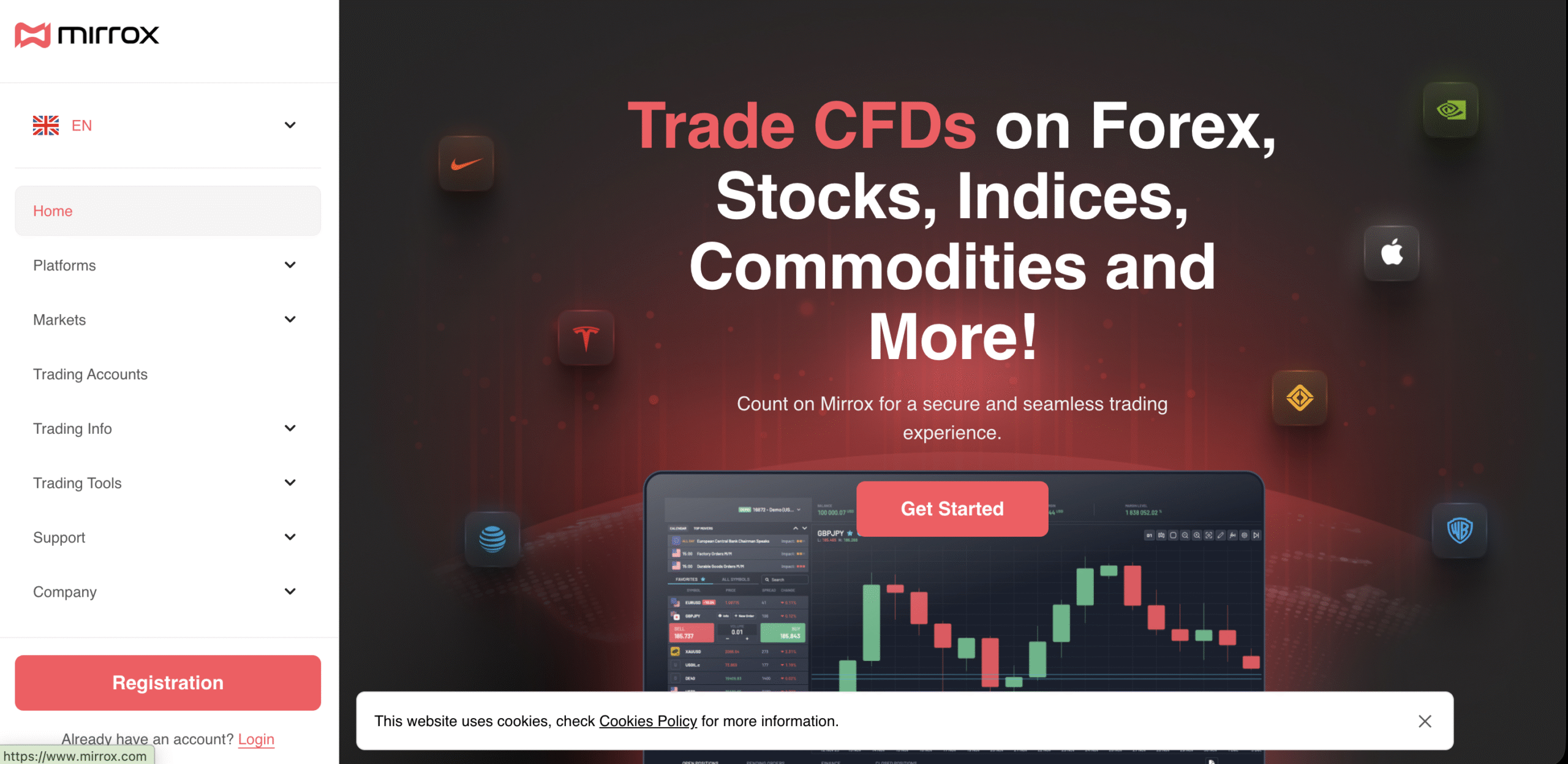

Section 1: The Platform’s Claims vs Reality

Investico.com presents itself as a multi-asset broker offering trading in Forex, commodities, indices, and cryptocurrencies. Its website emphasizes:

-

Global accessibility

-

Advanced trading tools for all experience levels

-

Professional support and account management

-

Multiple asset types for diversified trading

At first glance, the platform projects professionalism. It lists a physical office in South Africa and highlights what seems to be regulatory compliance. However, further investigation reveals discrepancies between claims and operational reality.

Section 2: Seven Shocking Weaknesses

2.1 Aggressive Deposit Pressure

Users report persistent calls and messages urging additional deposits. Many describe feeling manipulated to increase their account balance under the guise of unlocking higher returns. This aggressive approach is consistent with patterns seen in high-risk platforms.

For guidance on how to respond to high-pressure trading solicitations, check our crypto safety strategies to protect your funds and data.

2.2 Withdrawal Difficulties

One of the most consistent complaints involves blocked or delayed withdrawals. Small initial withdrawals may succeed, but larger sums often encounter unexplained “verification” delays or outright account freezes. Users report needing to submit repeated documentation and still receiving no response.

Platforms operating without reliable withdrawal mechanisms expose investors to financial loss and personal data risk. This lack of transparency signals that funds are not securely segregated.

2.3 Misleading Claims and Overpromises

Investico.com frequently advertises AI-driven trading systems and “guaranteed profits,” which are inconsistent with the unpredictable nature of markets. Many users report that promised returns are never realized, highlighting a gap between marketing and reality.

External regulators emphasize that no legitimate broker can guarantee profits. Referencing verified platforms and independent risk analysis is essential, such as our guide on verifying platforms.

2.4 Lack of Regulatory Transparency

A critical weakness lies in unclear or unverifiable licensing. The platform claims compliance in multiple jurisdictions, but there is no independent proof of registration with recognized authorities. Legitimate brokers maintain verifiable licenses that can be checked with regulators such as the Financial Conduct Authority (FCA) in the UK.

Investors should always confirm that a platform’s regulatory claims are genuine before depositing significant funds.

2.5 Hidden Fees and Currency Conversion Risks

Users report unexpected deductions and currency conversion issues when making deposits. Hidden fees are rarely disclosed upfront, creating a mismatch between expected and actual account balances. Over time, these discrepancies can significantly erode potential profits.

2.6 Limited Independent Reputation

Searches for reviews and ratings reveal low online visibility and minimal third-party verification. User forums and trust-scoring services consistently flag the platform as high-risk. Low independent presence can indicate a lack of genuine user base and insufficient operational transparency.

This weak external footprint contrasts sharply with more established brokers who maintain comprehensive records and reviews.

2.7 Aggressive Advertising and Recruitment Tactics

Investico.com relies heavily on online ads and affiliate-driven recruitment, often targeting inexperienced traders. Promises of quick gains and exclusive bonuses lure new users into depositing early and frequently. This type of marketing strategy is a hallmark of high-risk platforms that prioritize capital collection over client success.

Section 3: How Patterns Suggest Scam-Like Behavior

Analyzing user-reported experiences, a pattern emerges:

-

Users are enticed via social media or online ads.

-

Low initial deposits appear to generate small profits, creating trust.

-

Pressure from account managers encourages larger deposits.

-

Withdrawal requests encounter delays, verification hurdles, or denial.

-

Account access may become restricted while communications dwindle.

This sequence mirrors behaviors observed in fraudulent platforms globally. While no single factor proves illegitimacy, the combination raises significant concern.

Section 4: Risks Investors Face

Potential investors encounter several overlapping risks:

-

Financial Loss: Deposits may be unrecoverable if withdrawals fail.

-

Data Exposure: Platforms may request personal and banking information, risking identity theft.

-

Emotional Stress: Persistent calls and unresolved account issues create anxiety.

-

Regulatory Void: Operating without proper oversight means there is no recourse if funds disappear.

Understanding these risks can help investors make informed decisions and avoid costly mistakes.

Section 5: Tools and Resources for Protection

Investors can take proactive steps to protect themselves:

-

Check Regulation: Verify licensing with recognized authorities like the FCA or equivalent.

-

Review Experiences: Read multiple independent reviews to identify recurring complaints.

-

Test Withdrawals: Make small deposits first to test fund accessibility.

-

Use Recovery Resources: Platforms like Lost Funds Recovery consultation services can help assess risk and advise on recovering lost funds.

-

Evaluate Marketing Claims: Treat guaranteed returns and AI-trading promises skeptically.

Section 6: Legal and Operational Concerns

Operating without verifiable licensing may violate financial regulations, exposing users to deception and unfair practices. Hidden fees, blocked withdrawals, and aggressive recruitment further compound legal and ethical issues. Users are encouraged to maintain detailed records and consider reporting platforms engaging in suspicious practices to regulatory bodies or legal advisors.

Section 7: Key Takeaways

-

Seven major weaknesses demonstrate the platform’s high-risk profile.

-

Withdrawals, transparency, marketing claims, and regulatory ambiguity are central concerns.

-

Consistent user complaints corroborate technical and operational flaws.

-

Platforms with low external credibility should be approached with extreme caution.

Section 8: Action Steps for Victims

If you’ve lost funds to Investico.com:

-

Report the incident promptly to Lost Funds Recovery, which specializes in recovery and consultation.

-

Educate yourself using guides on what to do after a scam and platform verification to prevent repeat incidents.

-

Consult legal or financial professionals when necessary to safeguard your remaining assets.

References & External Links

-

Financial Conduct Authority (FCA) – Verify licenses of UK-regulated brokers.

-

Investico.com User Experiences – Broad hub of information on high-risk platforms.

Final Note:

The combination of withdrawal issues, misleading claims, aggressive recruitment, and regulatory opacity makes Investico.com a platform with substantial risk. Observing these seven shocking weaknesses can prevent financial loss and provide actionable insight for safer trading.