Introduction

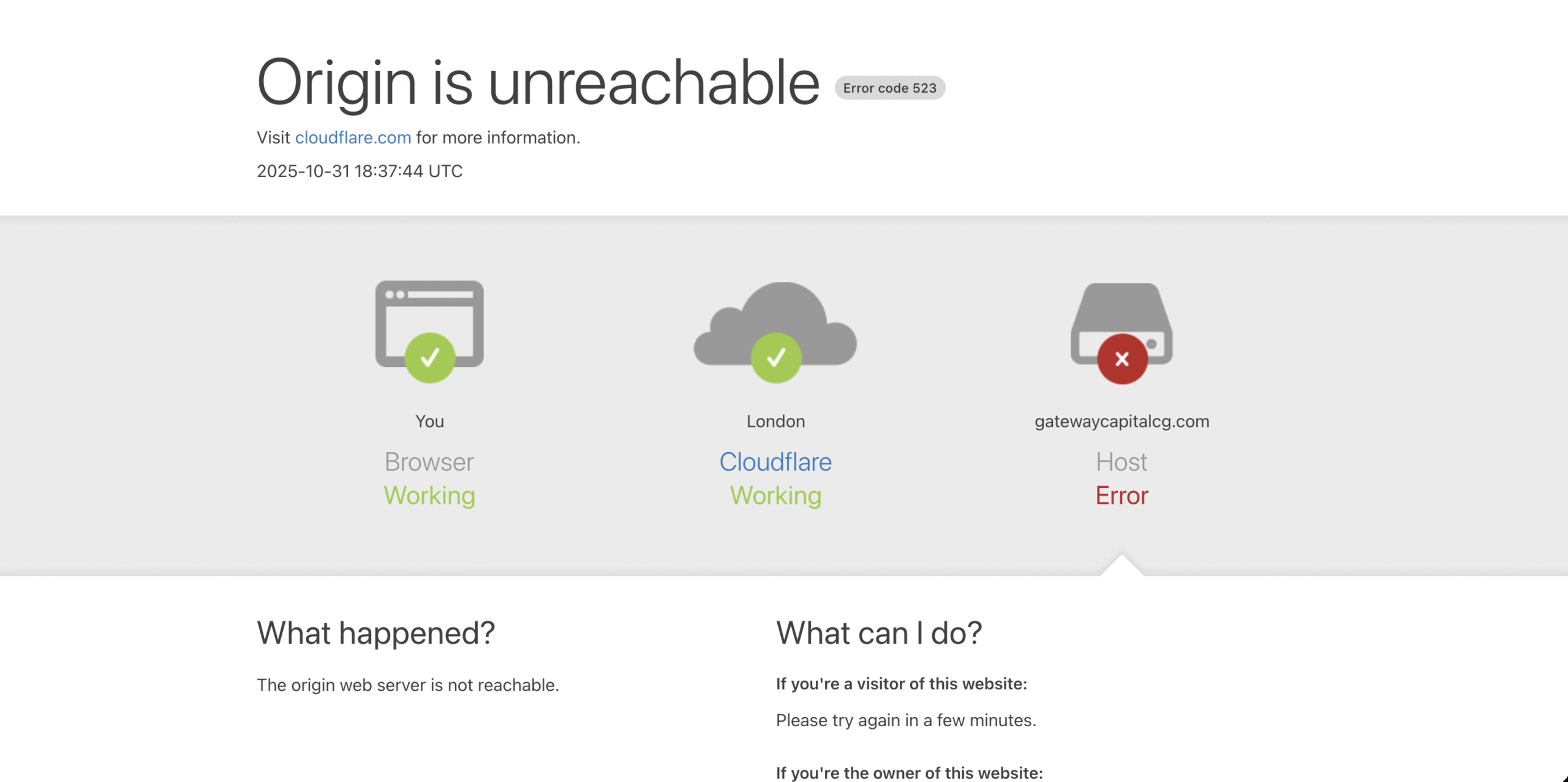

In the fast-moving world of online trading, new investment platforms appear almost every week, each promising cutting-edge technology and quick financial freedom. Yet among legitimate brokers are many sophisticated frauds designed to exploit that same desire for opportunity. One of the most concerning examples in recent memory is GatewayCapitalCG.com, a platform that has generated widespread complaints, regulatory alerts, and online outrage.

This article provides a clear, detailed look at how Gateway Capital CG operates, the warning signs surrounding it, and why financial experts and consumer advocates widely consider it a scam operation rather than a legitimate broker.

1. What Gateway Capital CG Claims to Be

GatewayCapitalCG.com presents itself as a global investment and trading company offering access to foreign exchange markets, stocks, commodities, and other financial instruments. Its website features glossy marketing language, high-resolution stock imagery, and promises of “secure investing” and “experienced financial advisors.”

It claims to provide a modern trading platform with professional-grade analytics, dedicated account managers, and strong returns on investment. At first glance, the website appears professional, borrowing heavily from the visual style of legitimate brokerage firms. However, upon closer inspection, the façade begins to crack.

Visitors soon notice vague descriptions of regulation, missing corporate addresses, and a lack of verifiable information about who actually owns or runs the company. There are no transparent details about licensing jurisdictions, physical headquarters, or key management figures. For experienced investors, these absences are immediate red flags.

2. A Pattern of Regulatory Red Flags

The most reliable indicator of a broker’s legitimacy is its regulatory status. Gateway Capital CG fails this test entirely. Financial authorities across multiple countries have identified it as an unauthorised firm.

In particular, the platform has been listed in several public investor-alert databases. These warnings state that Gateway Capital CG is not licensed to offer investment or trading services. Such statements are not issued lightly — they mean that regulators found enough evidence to conclude the firm is operating outside the law.

When a financial entity is unlicensed, any trading activity or “advice” it provides is illegal within those jurisdictions. Victims of such firms are not protected by financial-compensation schemes, and regulators cannot enforce the return of lost funds. In short, investors have no safety net.

This alone should be enough to make anyone steer clear. Yet many still fall prey to Gateway Capital CG because the scam operates with remarkable sophistication and polish.

3. How the Scam Works

The fraud model used by GatewayCapitalCG.com is not new. It follows the blueprint of thousands of other fake trading platforms, refined to appear more professional each year. The process unfolds in predictable stages:

Stage 1: The Hook

The operation begins with digital marketing — social-media ads, Google campaigns, or online videos that promise easy profits from forex or crypto trading. Sometimes, potential victims are contacted through cold calls or unsolicited emails.

The ads often use testimonials, fabricated celebrity endorsements, or fake media coverage to establish credibility. Visitors who click on the ads are taken to a professional-looking site that invites them to register for a “free trading account.”

Stage 2: The Personal Touch

Once a user signs up, they are contacted by an “account manager” or “financial advisor.” This person seems friendly, knowledgeable, and persistent. They may reference market trends or offer “training sessions.” Their goal is simple: persuade the investor to deposit money.

At this stage, the scammer builds trust by keeping the requested amount low — usually a few hundred dollars. They walk the investor through the deposit process, often asking for credit-card payments or direct transfers to offshore accounts.

Stage 3: The Illusion of Profit

After the first deposit, the victim gains access to an online dashboard that simulates real trading activity. The interface looks legitimate, showing live charts and profit numbers that rise rapidly. Within days, the investor believes they have already earned strong returns.

This illusion of success is crucial. The platform’s data is completely fabricated, controlled by the scammers to show whatever numbers will best encourage larger investments.

Stage 4: The Pressure Escalates

Once the investor is hooked by apparent success, the account manager calls again. They praise the investor’s “smart choices” and explain that “bigger profits require a larger portfolio.” Victims are urged to deposit thousands more to “upgrade their account level” or “unlock premium trading signals.”

The tone gradually shifts from friendly to urgent. Investors are told that markets are moving fast, that opportunities are closing, or that they need to act immediately to secure gains.

Stage 5: The Trap Closes

Eventually, when the investor tries to withdraw money, excuses begin. The company claims there are technical problems, compliance requirements, or taxes to be paid before withdrawal. Victims are asked for additional fees or further deposits to “verify their account.”

No matter what they do, withdrawals never occur. Emails go unanswered, phone lines go silent, and access to the trading dashboard may suddenly vanish. By the time victims realise what has happened, the scammers have disappeared with their money.

4. Signs of a Fake Investment Platform

Understanding the mechanics of such scams helps prevent others from falling into the same trap. Gateway Capital CG exhibits nearly every hallmark of a fraudulent broker.

Lack of Regulation

Legitimate brokers proudly display their licence numbers and are easily verifiable in government databases. Gateway Capital CG’s claims of regulation are vague, with no official registration number or recognised authority.

Hidden Ownership

The company offers no transparent information about its founders or executives. Its domain registration is private, shielding the real operators behind layers of anonymity.

Fake or Cloned Websites

Many scam brokers reuse identical templates. Comparing Gateway Capital CG’s site design and text reveals striking similarities with several other known scam platforms — evidence of a common network.

Unrealistic Returns

Marketing materials promise high, consistent profits with minimal risk. Genuine trading firms never make such guarantees because market returns are unpredictable.

Aggressive Sales Behaviour

Victims report persistent phone calls and emails urging immediate deposits. This high-pressure tactic is standard among scams.

Withdrawal Refusals

The surest sign of fraud is a refusal to release funds. Victims repeatedly describe failed withdrawal attempts and sudden account suspensions once they request their money.

5. Why So Many People Fall for It

The psychology behind online investment scams is powerful. Fraudsters exploit a mixture of trust, greed, and fear of missing out.

Gateway Capital CG’s operators understand that many people are unfamiliar with the inner workings of financial regulation. They rely on surface credibility — professional design, fake testimonials, and polite “advisors.” For inexperienced investors, these signals look authentic.

Additionally, scammers use emotional manipulation. They celebrate small successes with their victims, call them “smart investors,” and build a sense of partnership. Once confidence is established, victims are more willing to deposit larger sums or follow instructions without question.

Finally, the illusion of control created by the trading platform is critical. Investors can see their supposed balance increasing, which triggers dopamine and reinforces trust. They believe they are witnessing real profits, when in fact the numbers are entirely fabricated.

6. The Human Cost

Behind every complaint about Gateway Capital CG is a real story of financial and emotional loss. Some victims report losing life savings, retirement funds, or borrowed money. Many describe intense shame and depression after realising they were deceived.

The emotional toll can be worse than the financial one. Victims often feel isolated, embarrassed, and reluctant to seek help. They may blame themselves for “being careless,” when in fact they were targeted by professionals who specialise in psychological manipulation.

These scams thrive on secrecy and silence. The more victims share their stories publicly, the harder it becomes for such fraudulent platforms to find new prey.

7. Lessons from the Gateway Capital CG Case

GatewayCapitalCG.com teaches several important lessons for investors and consumers.

Always Verify Regulation

Before sending money to any broker, check its licence with the relevant financial authority. If the company cannot be found in the regulator’s database, it is not authorised — no matter what the website claims.

Be Wary of Unsolicited Offers

Legitimate investment firms do not cold-call or email random individuals with promises of quick profits. Unsolicited investment opportunities are almost always fraudulent.

Treat Unrealistic Promises as Red Flags

Phrases like “guaranteed income,” “risk-free trading,” or “double your money in weeks” are hallmarks of scams. Markets simply do not work that way.

Avoid Pressure Tactics

Real brokers allow clients to make decisions at their own pace. If someone demands immediate payment or claims you’ll “miss your chance,” it’s a manipulation tactic, not a business opportunity.

Keep Records

Save all emails, messages, and transaction receipts from any investment interaction. Documentation is critical for identifying patterns of fraud and for reporting to consumer-protection bodies.

8. How Gateway Capital CG Operates Behind the Scenes

While details of the individuals behind Gateway Capital CG remain murky, analysts have pieced together elements of its infrastructure.

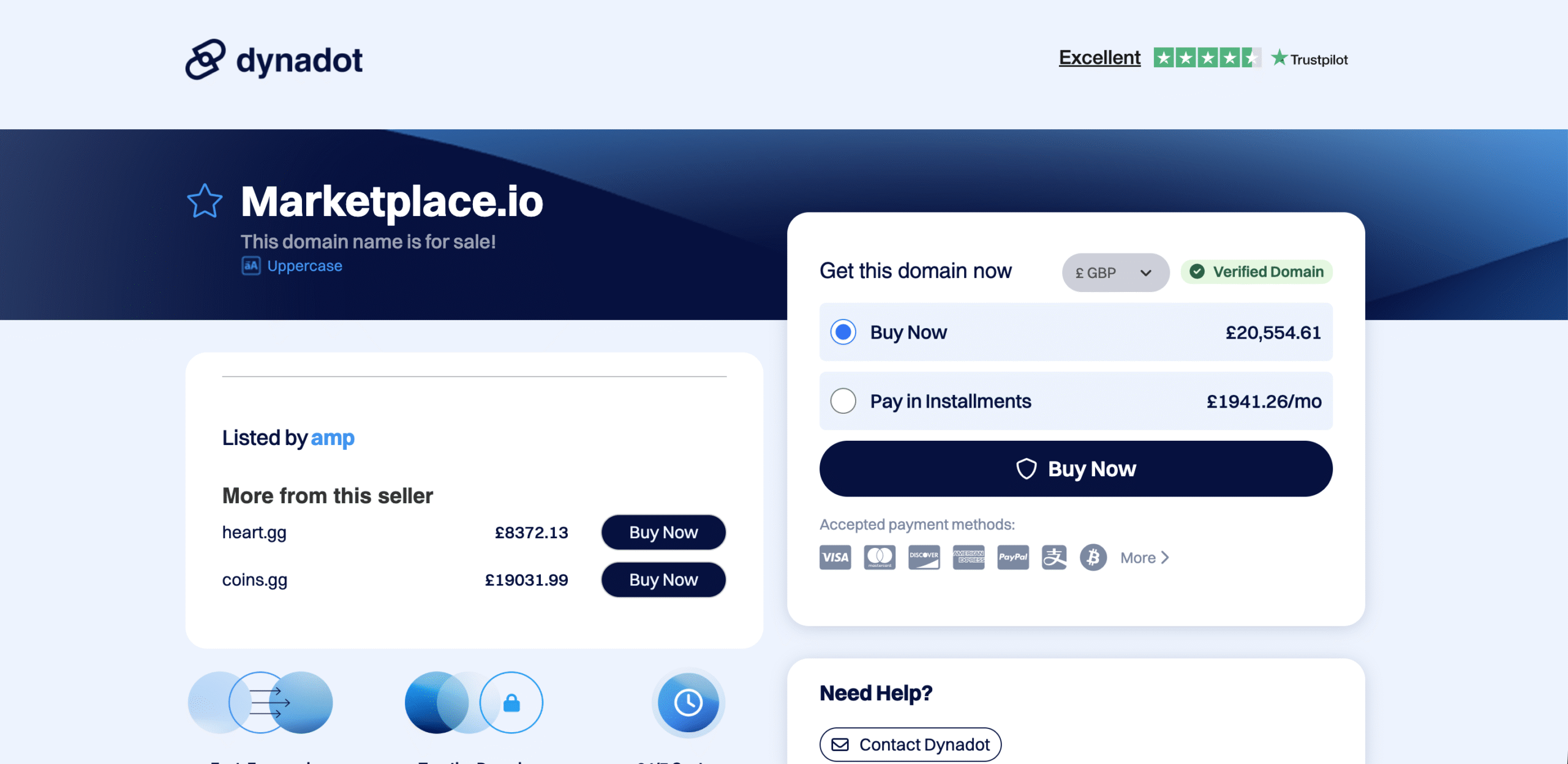

The domain uses privacy services that hide ownership information. Its web hosting is located offshore, often in jurisdictions known for weak enforcement. The website may clone design elements from other platforms, changing only the logo and colour scheme.

This kind of “boiler-room” network can launch and abandon dozens of scam brands every year. When one website becomes notorious or blocked, operators quickly relaunch under a new name, often reusing the same victim database.

In some cases, the same call-center employees may handle multiple fraudulent brands simultaneously, changing scripts and company names to match whichever website they are promoting that week.

Such operations are highly organised, blending marketing, technical manipulation, and psychological coercion into one seamless fraud system.

9. The Broader Problem of Online Broker Scams

Gateway Capital CG is far from unique. The last decade has seen an explosion of fake trading and investment websites, many of which follow identical patterns.

These scams exploit the deregulated nature of the internet, the global reach of social media advertising, and the anonymity of offshore finance. They are also aided by the glamour surrounding cryptocurrency and online trading — industries that attract people seeking fast wealth.

Despite growing awareness, the number of victims continues to climb. Fraudsters adapt quickly, using new technologies like AI-generated testimonials, deepfake videos, and cloned regulatory documents to appear more authentic than ever.

Consumer-protection agencies continually warn about these evolving tactics, urging people to treat all online investment opportunities with scepticism.

10. Key Takeaways for Safe Investing

The Gateway Capital CG saga reinforces fundamental rules for protecting yourself online:

-

Check registration first — verify the firm with official regulators.

-

Research reviews — search multiple independent review sites for patterns of complaints.

-

Be suspicious of secrecy — legitimate companies are transparent about location, staff, and governance.

-

Start small — test withdrawals before committing serious capital.

-

Use regulated payment channels — never send cryptocurrency or bank transfers to unknown offshore accounts.

-

Trust your instincts — if something feels off, it probably is.

These principles sound simple, yet they could prevent thousands of cases like Gateway Capital CG every year.

11. Why Public Awareness Matters

Fraudulent investment operations rely on the ignorance and optimism of their targets. The more the public understands how scams like GatewayCapitalCG.com operate, the less profitable these schemes become.

Consumer education is a powerful form of defence. When potential investors know what warning signs to look for, they can avoid being lured into fraudulent platforms. Sharing stories, writing reviews, and warning friends can stop the next person from becoming a victim.

Media coverage and investigative blogs play an essential role. Every time a scam is publicly exposed, it undermines the fraudsters’ ability to rebrand and continue deceiving new audiences.

12. Conclusion

GatewayCapitalCG.com presents itself as a gateway to financial success, but in reality, it is a well-disguised trap designed to extract money from unsuspecting investors. The combination of false regulatory claims, fabricated profits, and aggressive deposit tactics places it squarely in the category of online investment scams.

Its downfall lies not in sophisticated technology but in the same manipulative human psychology used by countless scams before it. Victims are promised freedom, security, and wealth — but receive only loss and frustration.

The story of Gateway Capital CG serves as a stark reminder that in finance, trust must be earned, not advertised. Any company unwilling to disclose its credentials, honour withdrawals, or operate under proper oversight should be treated as dangerous.

In an age when anyone can build a convincing website overnight, due diligence is the investor’s greatest defence. The best protection is awareness, scepticism, and a firm refusal to let greed override caution.

Report GatewayCapitalCG.com scam and Recover Your Funds

If you have lost money to GatewayCapitalCG.com, it’s important to take action immediately. Report the scam to LOSTFUNDSRECOBERY.COM, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like GatewayCapitalCG.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.

Stay smart. Stay safe.