Introduction

The world of online trading and investment offers vast opportunities—and huge risks. In recent years, scam platforms targeting inexperienced investors have proliferated. Among them, Pinament.com has drawn significant attention and controversy. While it presents itself as a legitimate broker or trading service, a growing body of evidence from user reviews and independent analysis strongly suggests that Pinament.com may be a fraudulent operation.

In this post, we examine Pinament.com in depth: its background, red flags, user testimonies, technical and regulatory issues, and how to stay safe. If you’re considering using Pinament.com—or if someone you know has already invested—this breakdown will help you make an informed decision.

What Is Pinament.com?

Pinament.com claims to be a financial broker, offering trading services to retail clients. According to its marketing materials, its mission is “to provide an outstanding trading experience by integrating innovative solutions with unparalleled customer service.” It provides a US address and a phone number, along with an email for support.

At face value, it may look legitimate: a slick website, a professional tone, and promises of high returns. But when you scratch beneath the surface, many troubling signs emerge.

Warning Signs and Red Flags

1. Very Poor Trust Rating

One of the most obvious warning signals is Pinament.com’s low rating on review platforms. Diving into user reviews, a large majority are highly critical:

-

Many users claim they cannot withdraw their money.

-

Several say Pinament.com demands extra deposits just to release withdrawal requests.

-

Others allege fake “analysts” or “investors”, fake earnings, and a lack of real market exposure.

-

Some reviewers claim the company uses unverified “scammers” posing as contracted agents tied to major financial firms.

-

One review even mentions that Pinament.com uses a fake license, transferring customer funds to untraceable wallets.

These are not isolated complaints — they create a consistent pattern across multiple users.

2. Poor Reputation in Scam-Analysis Tools

Analysis tools that assess website legitimacy also flag Pinament.com as risky:

-

The domain is very young, indicating it was only recently established.

-

Ownership details are hidden, making it hard to verify who is really behind the company.

-

While the site has a valid SSL certificate, this alone doesn’t guarantee legitimacy—fraudsters frequently use SSL to appear trustworthy.

-

The website’s traffic and presence are minimal, suggesting it is not a well-established or widely recognized platform.

Another related domain, PinamentPanel.com, which appears to be tied to Pinament’s internal client portal, is also deeply suspect. Key issues include:

-

Very young domain.

-

High use of privacy-protection services to hide registration details.

-

Low ranking and limited third-party presence, suggesting it’s not widely recognized.

-

Labeled as potentially misleading and risky.

3. Business & Operational Red Flags

Lack of Regulatory Transparency

A major concern with Pinament.com is regulatory legitimacy. Legitimate brokers typically showcase clear regulation (e.g., FCA in the UK, SEC in the US, or equivalents elsewhere). In the case of Pinament:

-

There is no publicly verifiable regulatory registration clearly displayed.

-

Users report suspicions that Pinament.com’s license may be fake or misrepresented.

-

Without proper regulation, customer funds may not be protected, increasing the risk if the company is fraudulent or collapses.

Behavioral Red Flags

From user accounts, several characteristic behaviors of known scam operations emerge:

-

Withdrawal difficulties or outright denials: Users report being unable to withdraw funds.

-

Ghosting: Support becomes unresponsive after deposit or withdrawal requests.

-

Extra deposit demands: Users claim they are asked to deposit additional money to access their accounts.

-

Fake “analysts” or “trainers”: Individuals posing as financial experts may be part of the scheme.

-

Organized crime allegations: Some reviews claim the company may be operated by organized crime, though such claims are hard to independently verify.

Anatomy of the Alleged Scam

Putting together all the pieces, here’s a likely scenario of how Pinament.com might operate as a scam:

-

Welcome and Onboarding

-

New customers are approached or find the site.

-

They are given a polished presentation, possibly including “analysts” or “trainers.”

-

A small initial deposit is requested.

-

-

Fake Gains

-

The platform may show simulated profits, convincing users their investment is growing.

-

Users are encouraged to deposit more, promising higher returns.

-

-

Withdrawal Request

-

When users try to cash out, they are asked to pay extra fees or are told their withdrawal request is under review.

-

-

Stalling & Blocking

-

Support becomes less responsive.

-

Accounts may be “suspended” or “blocked.”

-

Users may never see their money again.

-

-

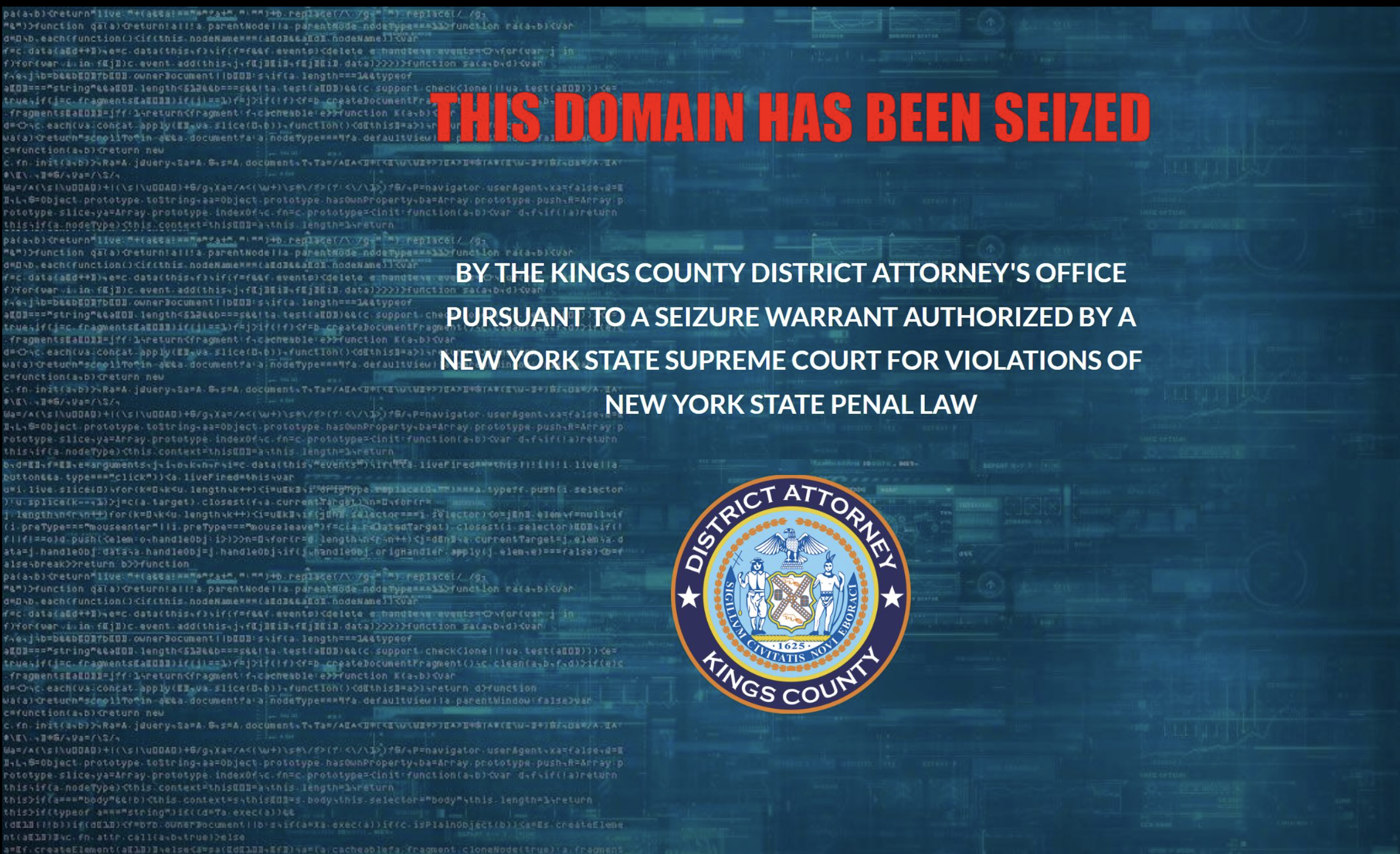

Disappearance or Exit

-

The site may vanish, shut down, or change its name.

-

By then, most victims have lost access to their funds.

-

Why Does Pinament.com Seem to Work (at Least Initially)?

It’s helpful to understand why some people fall for it, or why it might look plausible at first glance:

-

Professional facade: The site is well-designed and appears legitimate.

-

“Analysts” build trust: Assigned “trainers” give advice to gain confidence.

-

Simulated returns: Fake profits encourage larger deposits.

-

Low barrier to entry: Initial deposits may seem minimal.

-

Scarcity and urgency tactics: Pressure to act quickly is commonly used.

Counterarguments & Caveats

-

Not every negative review guarantees a scam: Some complaints may be about delayed withdrawals or miscommunication.

-

Some users claim success: A small number of positive reviews exist, but they may be biased or manipulated.

-

Lack of easily accessible regulatory info: Not all brokers display clear licenses, though legitimate ones usually do.

Still, the volume and consistency of negative reports, along with independent trust metrics, suggest high risk.

How to Protect Yourself & What to Do If You Have Invested

If You Haven’t Invested Yet

-

Do deep research

-

Check independent review platforms for user experiences.

-

Use website-reputation tools to assess trustworthiness.

-

Search for verifiable regulatory registration.

-

-

Start very small

-

Deposit a minimal amount to test the platform before committing more.

-

-

Request withdrawal early

-

If withdrawals are denied or delayed, this is a strong warning signal.

-

-

Avoid isolated or poorly regulated platforms

-

Prefer brokers regulated in reputable jurisdictions (FCA, CySEC, ASIC, etc.).

-

Choose platforms with strong reputations and transparent operations.

-

-

Be wary of unrealistic promises

-

High, guaranteed returns with little risk are almost always a red flag.

-

If You’ve Already Invested

-

Document everything

-

Save emails, chat logs, transaction receipts, and account statements.

-

Take screenshots of dashboards, earnings, or failed withdrawal messages.

-

-

Try to withdraw

-

Submit a withdrawal request and carefully document the response.

-

-

Escalate

-

Contact your bank or payment provider and request investigation or reversal if possible.

-

File a complaint with your local financial regulator.

-

-

Warn others

-

Share your experience on review platforms or financial forums to help others avoid the risk.

-

Broader Lessons & Take-Home Points

Pinament.com may not be the first or only broker that raises red flags—but its case illustrates common themes in online financial scams:

-

Compelling pitch + polished facade: Scammers know how to appear professional.

-

Pressure to invest more: Encouraging additional deposits is a core tactic.

-

Fake or misleading regulation: Without verifiable oversight, customer funds are at risk.

-

Manipulated “profits”: Unrealistic earnings lure victims.

-

Withdrawal traps: Denials, extra fees, or blocked accounts are common.

-

Use of “helpful” intermediaries: Analysts, trainers, or account managers may be part of the deception.

For investors, the crucial lesson is to always do your homework, demand transparency, and never risk more than you can afford to lose, especially with unknown or poorly regulated platforms.

Conclusion

Based on the available evidence, Pinament.com exhibits many red flags strongly associated with online investment scams. Low user ratings, widespread complaints about withdrawals, accusations of fake staff, and poor trust metrics all paint a worrying picture.

While not every user may fall victim, the risk is clearly significant. For people considering trading or investing via Pinament.com, extreme caution is advised. If you’ve already put money in, prioritize gathering proof, attempting to withdraw, and escalating the issue through your bank or financial authorities.

The Pinament.com case reinforces a timeless lesson for investors: when something looks too good to be true, it often is. Careful research, verification of regulatory credentials, and disciplined risk management remain the best defenses against scams.

Report Pinament.com Scam and Recover Your Funds

If you have lost money to Pinament.com, it’s important to take action immediately. Report the scam to LOSTFUNDSRECOBERY.COM, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Pinament.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud. Read More reviews at Scams2Avoid