Introduction

In the digital finance landscape, cryptocurrency has opened a world of opportunity—but also a floodgate for scams. Every month, thousands of new trading and wallet platforms emerge, each claiming to be the next big thing in blockchain technology. Some are legitimate innovators, but many are little more than smoke and mirrors.

One of the latest platforms drawing suspicion is BitflowAssets.com. On the surface, it promises security, innovation, and massive profits through crypto asset management. But when you peel back the glossy interface, the signs of a scam become glaringly obvious. This deep-dive blog explores the red flags, patterns, and deceptive tactics used by BitflowAssets.com to lure unsuspecting investors.

What BitflowAssets.com Claims to Offer

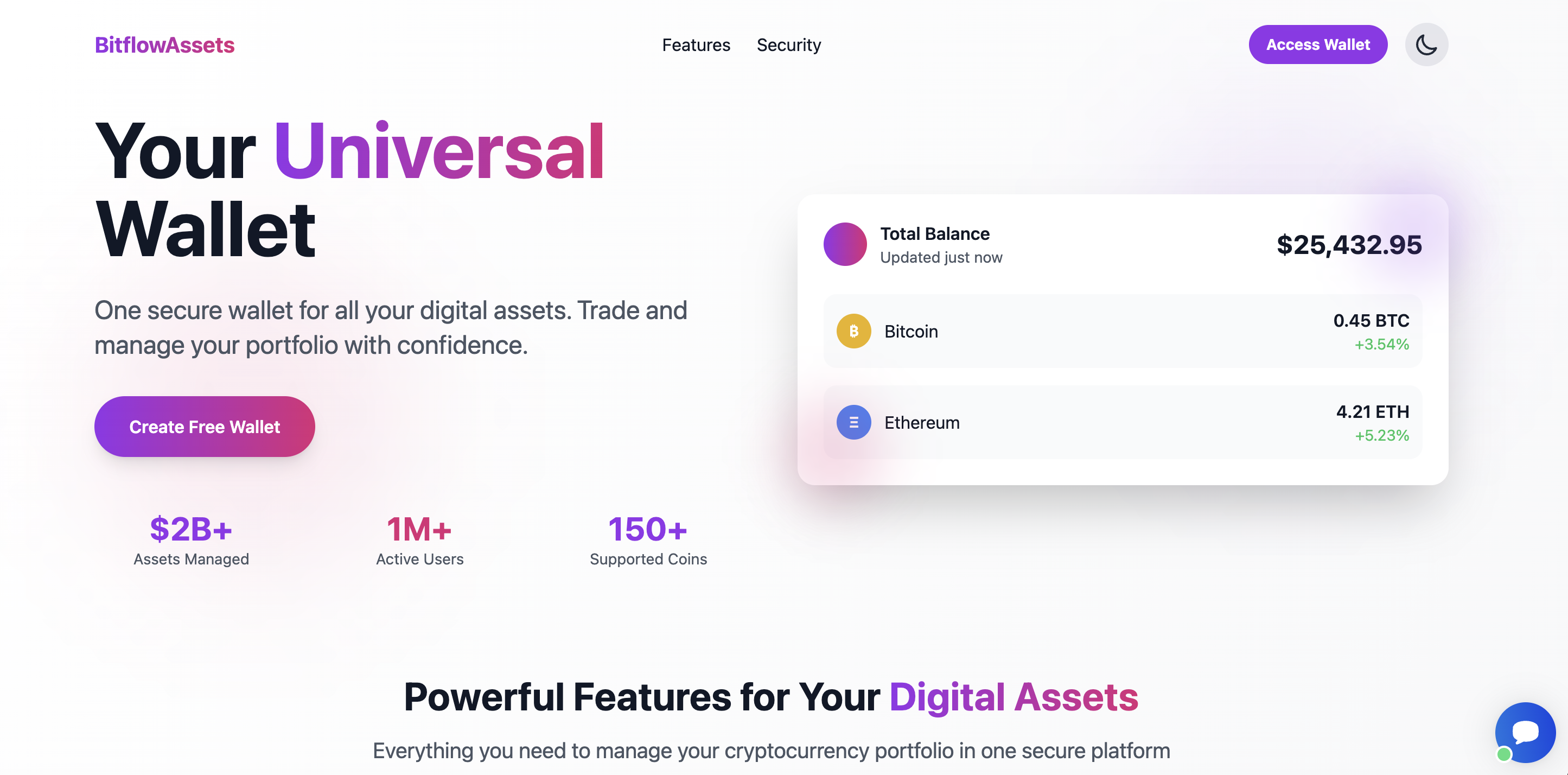

BitflowAssets.com presents itself as a sophisticated, all-in-one crypto wallet and trading platform. It uses slick marketing and modern website design to give the impression of legitimacy.

According to its promotional content, the platform claims to:

-

Offer a multi-chain crypto wallet compatible with major networks like Ethereum, Binance Smart Chain, and Polygon.

-

Provide portfolio management tools and asset tracking features.

-

Allow users to stake, swap, and trade various tokens seamlessly.

-

Guarantee “bank-grade” security through multi-signature verification, biometric authentication, and hardware wallet integration.

-

Manage over $2 billion in user assets and serve more than one million active users.

In short, the platform markets itself as a trustworthy and technologically advanced crypto management service—a one-stop shop for digital asset investment.

However, these grand claims crumble under scrutiny.

Major Red Flags Exposed

1. A Suspiciously New Domain

The first and most basic check on any online investment service is its domain age. BitflowAssets.com is an extremely new website, created only months ago. In the financial sector, a short domain history is a major red flag. Legitimate companies tend to have established web presences, verifiable histories, and consistent branding.

Fraudulent operations often create new domains, operate for a few months to extract money from investors, then vanish—only to reappear under a new name.

2. Hidden Ownership and Lack of Transparency

No legitimate financial company hides its ownership information. BitflowAssets.com, however, provides no verifiable corporate details. There’s no public record of who owns or operates the platform, no named executives, and no physical business address.

The site claims to be “licensed” and “incorporated,” even citing a company number—but there is no way to verify this through any government or financial registry. This tactic is typical of fraudulent investment platforms: use vague references to licenses or certificates that look official but are meaningless.

When a financial entity is this secretive about its leadership and location, it’s not protecting privacy—it’s concealing accountability.

3. Over-the-Top Marketing Claims

Legitimate businesses let their results speak for themselves. Scams, on the other hand, rely on exaggerated promises to lure deposits.

BitflowAssets.com claims to manage billions of dollars in assets and to have over a million users, yet there is zero evidence supporting these numbers. There are no press releases, third-party audits, public statistics, or known partnerships that validate such figures.

The language is designed to trigger trust and greed simultaneously—convincing visitors that they are joining a massive, successful network when in reality, they are among the first targets of a fraudulent operation.

4. Poor External Trust Ratings

When analyzed by independent security tools and online risk evaluators, BitflowAssets.com scores very poorly on trustworthiness. It has been classified as “dubious,” “suspicious,” and “potentially fraudulent” across several site-verification systems.

Low trust scores, coupled with its new registration date, suggest that the domain lacks any digital footprint of reliability. A truly established financial service would have consistent mentions in crypto forums, news outlets, and social media discussions. BitflowAssets.com has virtually none.

5. Fake User Reviews

Another striking sign of deception lies in the pattern of user reviews. While a handful of generic, overly positive testimonials exist, the majority of independent reviews call the platform a scam.

Common complaints include:

-

Fake or non-existent account balances.

-

Inability to withdraw funds.

-

Requests for additional “transfer fees” or “verification payments.”

-

Unresponsive or vanishing customer support.

This pattern is textbook behavior for investment scams. At first, users may see small “profits” on their dashboards to build trust. Then, when they attempt to withdraw, the platform demands extra payments or stops communicating altogether.

6. Questionable Credentials and Certificates

The website displays what appears to be a certificate of incorporation with a company number, giving the illusion of official registration. But further investigation shows no trace of this company number in any legitimate corporate database.

Many scams use fake incorporation documents created with editable templates. These images look convincing to casual visitors but have no legal basis whatsoever. A credible company should provide a verifiable registration in a public government database—not just a decorative certificate.

7. Reports of Fake Cryptocurrency

Several users have reported being given “fake USDT” (Tether) tokens or seeing balances on the platform that don’t exist on the blockchain. This indicates that BitflowAssets.com is not a real wallet at all, but rather a controlled environment that merely simulates ownership of crypto assets.

Scammers often create web interfaces that imitate real wallets. Users believe they are holding coins, but all data is stored on the scammer’s servers. There are no genuine blockchain transactions behind the scenes.

8. Classic “Withdrawal Fee” Scam Pattern

A defining feature of fraudulent crypto investment platforms is the withdrawal trap. Users are told they must pay additional fees—such as taxes, security deposits, or processing charges—before they can access their funds.

Once a user sends these extra payments, the scammers disappear or continue to demand more. BitflowAssets.com follows this pattern precisely, as multiple users report being charged various fees under false pretenses.

How the BitflowAssets Scam Likely Operates

Understanding the step-by-step mechanics of such a scam helps reveal how investors are deceived. BitflowAssets.com appears to follow a common playbook used by fraudulent “wallet” and “investment” platforms.

-

Attract the investor

-

Eye-catching marketing, sleek web design, and bold claims about “secure asset management” draw in visitors.

-

-

Encourage deposits

-

The user is urged to “activate” an account by depositing cryptocurrency such as USDT, ETH, or BTC.

-

-

Simulate profits

-

Once the funds are deposited, the user’s dashboard shows increasing balances or trading profits, which are completely fabricated.

-

-

Create barriers to withdrawal

-

When the user attempts to withdraw funds, they are told to pay a “transfer fee” or “network tax.”

-

-

Continue extracting money

-

Each payment request is justified with a new excuse—security clearance, compliance verification, or wallet synchronization.

-

-

Disappear or block accounts

-

Eventually, when the victim refuses to pay more, the scammers disable the account or shut down the site entirely.

-

-

Rebrand and repeat

-

Once the operation becomes widely reported as a scam, the perpetrators move to a new domain with a new name, starting the cycle again.

-

Why BitflowAssets Appears Convincing

While the red flags are clear to an experienced observer, newcomers to crypto may find BitflowAssets.com believable at first glance.

The reasons include:

-

Professional design: The website looks clean and modern, featuring live price tickers, dashboards, and responsive layouts.

-

Use of technical language: Terms like “DeFi staking,” “multi-chain integration,” and “cold storage security” make the platform sound legitimate.

-

Displayed certificates and company numbers: Even though fake, these visuals add perceived credibility.

-

Promises of easy profits: The psychological lure of quick, effortless returns remains one of the most effective tools in financial fraud.

-

Minimal verification requirements: Users can create accounts easily, giving the impression of convenience and accessibility.

This combination of sophistication and simplicity makes BitflowAssets.com particularly dangerous. It is designed to trick both beginners and semi-experienced crypto users alike.

The Bigger Picture: Patterns in Modern Crypto Scams

BitflowAssets.com is far from unique. It follows a long-established formula used by dozens of similar platforms. The general characteristics include:

-

Short lifespan domains — Registered for a few months to run a quick operation.

-

Fake metrics — Claims of billions in managed assets without verification.

-

Fabricated reviews and testimonials — Positive feedback generated by bots or paid actors.

-

High-pressure tactics — Limited-time offers, special bonuses, and false urgency to prompt quick deposits.

-

Withdrawal restrictions — Victims are told they must pay extra to retrieve their funds.

-

Disappearing websites — Once the scam is exposed, the domain vanishes or redirects to a new one.

BitflowAssets.com fits this pattern perfectly, suggesting it’s part of a broader network of cloned scam platforms.

The Psychological Manipulation Behind the Scam

The success of platforms like BitflowAssets.com relies not only on technology but also on psychology. Scammers exploit human emotions to override rational decision-making.

-

Greed: The promise of high returns in a booming market encourages impulsive decisions.

-

Fear of Missing Out (FOMO): Seeing others supposedly profit from crypto investments makes users rush to join.

-

Trust in technology: The use of blockchain jargon and high-tech interfaces convinces users they’re dealing with professionals.

-

Hope: Even after losing money, victims often cling to the belief they can recover their funds, sending more in the process.

Understanding these psychological triggers is key to avoiding similar traps.

Why Regulation and Transparency Matter

Legitimate crypto businesses operate within clear legal frameworks. They publish company details, license numbers, executive teams, and contact information. They are also transparent about their security protocols and business models.

BitflowAssets.com fails on all fronts. There is no verifiable registration, no transparent ownership, and no disclosed physical headquarters. This lack of transparency is the single biggest indicator that the operation cannot be trusted.

In finance, anonymity is never a virtue—especially when it comes to managing other people’s money.

Summary of Key Warning Signs

Let’s summarize the major reasons BitflowAssets.com should be considered a scam:

-

Newly created, short-lived domain.

-

Hidden ownership and unverifiable licensing claims.

-

Overblown marketing promises without supporting evidence.

-

Low trust ratings from independent security analyses.

-

Numerous user complaints of lost funds and withdrawal issues.

-

Fake certificates and potentially counterfeit cryptocurrency balances.

-

Classic scam tactics involving “activation” or “withdrawal” fees.

Each of these factors alone is concerning. Together, they make the platform categorically unsafe.

Final Verdict

After examining all available information, BitflowAssets.com displays every characteristic of a fraudulent crypto platform.

The combination of deceptive marketing, anonymous management, fabricated credentials, and user complaints paints a clear picture: this is not a legitimate business, but a sophisticated digital scam designed to steal cryptocurrency deposits from unsuspecting users.

Any investor, trader, or casual crypto enthusiast should avoid this platform completely. The risks far outweigh any potential reward, and the evidence points overwhelmingly toward fraudulent intent.

If you encounter promotional material for BitflowAssets.com—or any site with similar language and structure—treat it with extreme caution. In today’s crypto environment, it’s far safer to assume such operations are scams until proven otherwise.

How to Stay Safe in the Crypto World

While scams like BitflowAssets.com are alarming, they can also serve as valuable lessons. Protecting yourself in the world of digital finance requires vigilance and skepticism.

Here are best practices for identifying and avoiding similar frauds:

-

Check domain age and history. Avoid newly created websites claiming massive operations.

-

Research ownership and licensing. Always verify corporate registration through official databases.

-

Ignore unrealistic profit promises. If something sounds too good to be true, it almost certainly is.

-

Test withdrawals early. On legitimate platforms, withdrawals should work smoothly and transparently.

-

Read independent reviews. Genuine companies have broad user feedback across multiple platforms.

-

Be cautious with deposits. Start small, and never invest more than you can afford to lose.

-

Prioritize regulation. Choose services registered under recognized financial authorities.

-

Keep emotions in check. Avoid making financial decisions driven by fear or greed.

By following these principles, you can significantly reduce the risk of falling victim to fraudulent platforms like BitflowAssets.com.

Conclusion

BitflowAssets.com is a polished but deceptive operation, crafted to look legitimate while hiding its true purpose: to extract cryptocurrency from users and vanish. Its website design, technical jargon, and false credentials are all part of a calculated illusion.

The platform represents a growing breed of sophisticated online scams exploiting the explosive popularity of cryptocurrency. The evidence of fraudulent behavior is overwhelming, and the safest course of action is total avoidance.

In a digital economy where innovation moves faster than regulation, personal vigilance remains the strongest defense. Always question, always verify, and never let glossy marketing override common sense.

BitflowAssets.com is not an opportunity—it’s a warning.

Report BitflowAssets.com Scam and Recover Your Funds

If you have lost money to BitflowAssets.com, it’s important to take action immediately. Report the scam to LOSTFUNDSRECOBERY.COM, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like BitflowAssets.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud. Read More reviews at Scams2Avoid