Introduction

The world of online trading has exploded in recent years, bringing opportunities for both legitimate investing and fraudulent operations. For every trusted brokerage, there are dozens of fake or unregulated platforms waiting to exploit inexperienced traders. One of the names that frequently comes up in scam reports is AlfaTrade.com, which claims to be an online trading broker offering forex and CFD services.

At first glance, AlfaTrade appears to be a professional brokerage. Its website uses modern graphics, references trading tools, and promises access to global financial markets. Yet, behind the façade of sophistication lies a long trail of complaints, missing regulatory credentials, and serious red flags that suggest AlfaTrade may not be what it claims.

This blog takes an in-depth look at AlfaTrade’s operations — examining its supposed credentials, user experiences, withdrawal issues, and scam indicators — to help you understand why so many traders consider it an outright fraud.

1. What AlfaTrade.com Claims to Be

According to its promotional materials, AlfaTrade.com presents itself as a fully functional international broker offering:

-

Forex, commodity, and CFD trading.

-

Professional trading platforms and analytical tools.

-

Opportunities for both beginners and seasoned investors.

-

Dedicated account managers and “safe” deposits.

It often advertises easy entry points, suggesting that anyone can start trading with a relatively small investment and generate steady profits in a short period. Many of its ads use aspirational language — focusing on “financial freedom,” “independence,” and “passive income.”

The company behind the site claims to be located in Europe, with some references pointing to Bulgaria or offshore locations such as St. Vincent and the Grenadines. This mix of claimed addresses and corporate details is already a red flag, as legitimate brokers typically provide verifiable and consistent business information.

2. Major Red Flags

A) No Legitimate Regulation

Perhaps the biggest warning sign about AlfaTrade.com is its lack of recognized financial regulation. The platform does not appear on any major financial regulator’s list of licensed brokers. It claims registration in offshore jurisdictions where there is little to no oversight.

This means AlfaTrade can legally avoid following strict standards for client fund protection, capital adequacy, and transparency. If something goes wrong — such as frozen funds or unfulfilled withdrawals — customers have no regulator to turn to.

B) Confusing or False Company Information

AlfaTrade.com lists multiple business addresses and names across different countries, sometimes changing the entity responsible for the brokerage. Such inconsistency is typical of fraudulent platforms that try to obscure their true location and ownership.

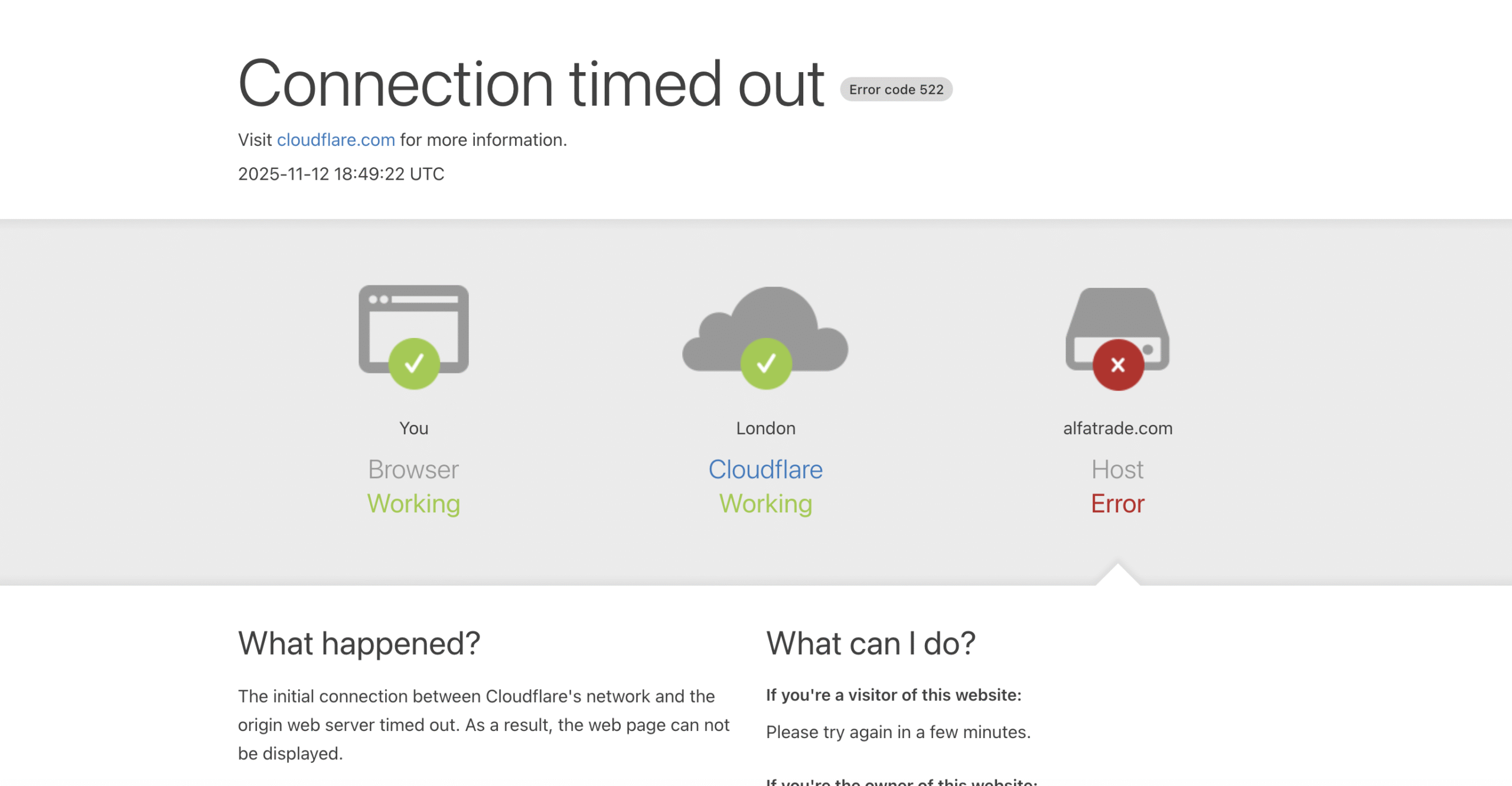

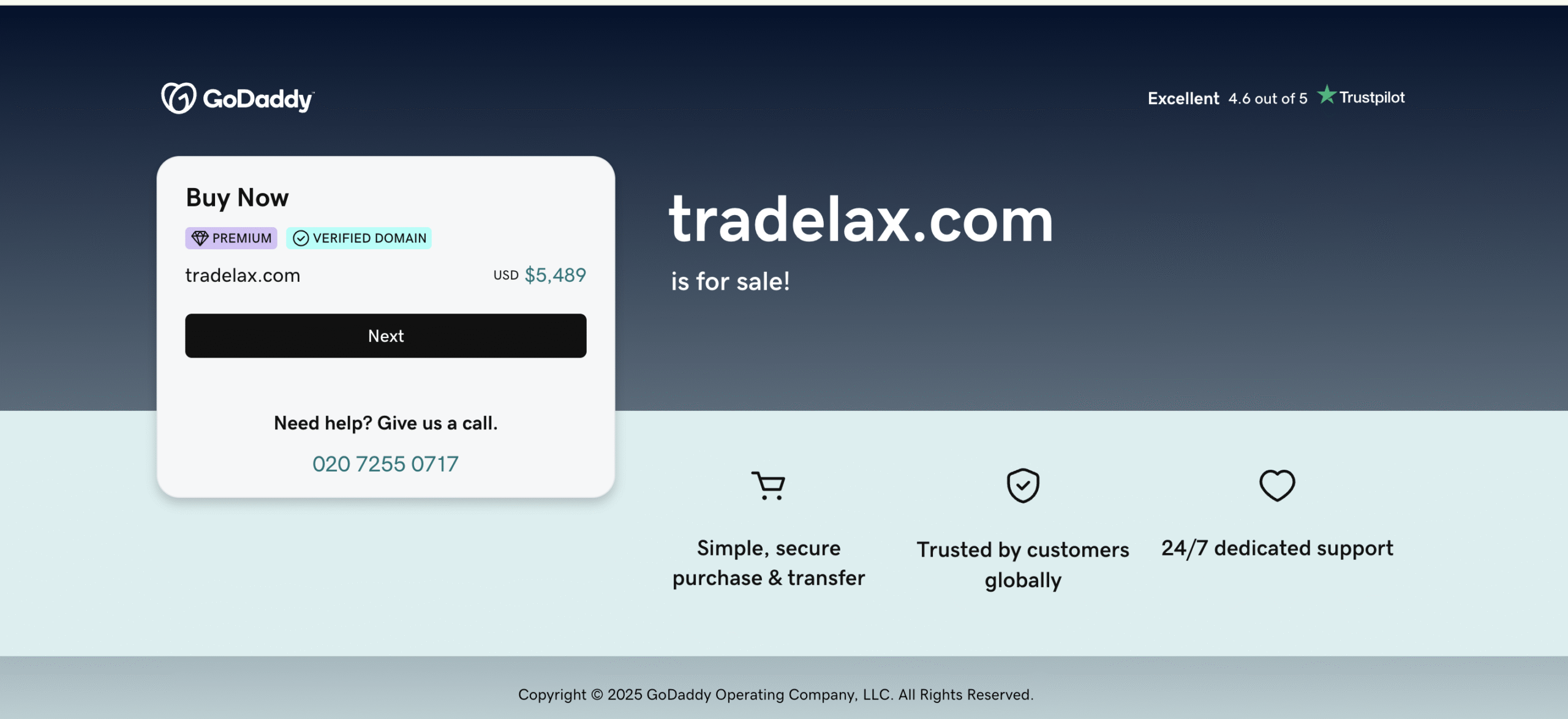

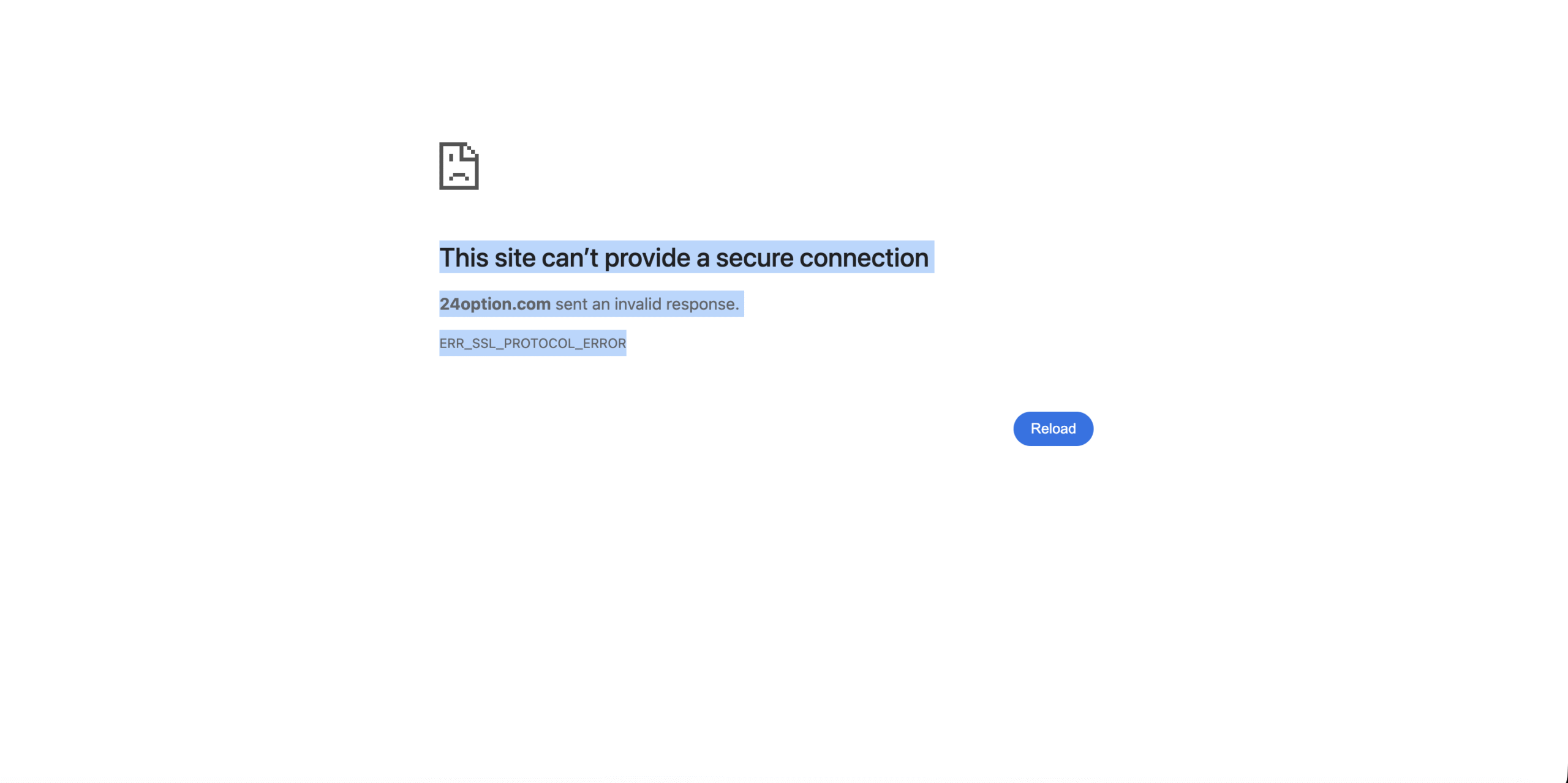

Even the domain itself has changed several times over the years, with different variations appearing and disappearing without notice. This instability indicates an attempt to stay one step ahead of public exposure or regulatory action.

C) Overwhelmingly Negative Customer Reviews

A quick look at trader feedback reveals an overwhelming number of complaints. Most reviewers report the same issues:

-

Fake account balances showing large “profits” that cannot be withdrawn.

-

Sudden rule changes preventing customers from selling or transferring assets.

-

Pushy “account managers” pressuring users to invest more.

-

Total loss of contact once a customer refuses to deposit additional funds.

These are consistent symptoms of a coordinated investment scam rather than a poorly managed brokerage.

D) Withdrawal Problems

Almost every complaint about AlfaTrade.com mentions trouble withdrawing money. Victims describe depositing funds easily, seeing supposed gains in their accounts, but being unable to retrieve even their original investment.

When they attempt to withdraw, new obstacles suddenly appear — such as “taxes,” “verification fees,” or minimum-trading-volume requirements that were never clearly disclosed. Some users are told they must pay thousands more to “unlock” their balance, which is a classic scam technique designed to extract more funds before cutting off communication entirely.

E) Offshore Registration

The company claims to be registered in offshore financial havens that are notorious for hosting unregulated brokers. These jurisdictions typically do not have strong investor-protection laws or strict financial oversight, making them a common choice for fraudulent operators.

F) Website & Domain Instability

Another notable pattern is the constant domain switching. AlfaTrade.com has used multiple web addresses over time, some of which are no longer active. This constant shifting makes it difficult for victims to track or pursue legal action once the site vanishes.

3. Common Experiences Reported by Users

When piecing together the numerous customer accounts, a consistent pattern of behavior emerges that clearly outlines how AlfaTrade operates.

Step 1: Persuasive Marketing and Contact

Users typically encounter AlfaTrade.com through online ads, social-media promotions, or unsolicited phone calls. The pitch is always the same: easy trading, minimal risk, and guaranteed profits. Representatives often sound professional and friendly, gaining trust quickly.

After initial contact, they encourage potential investors to deposit a small “starter amount” — often around $250 to $500 — claiming this is just to “test the system.”

Step 2: Early Success and Encouragement to Invest More

Once the initial deposit is made, the account begins to show profits within days. These gains are usually simulated and not tied to real trades. The illusion of success builds confidence, and the assigned “account manager” then persuades the investor to add more funds to “maximize gains.”

Some users report being given access to a basic trading dashboard that seems active, but in reality, the numbers are easily manipulated by the broker.

Step 3: The Blocked Withdrawal

Trouble begins when the investor tries to withdraw part or all of their funds. At this point, AlfaTrade.com invents new conditions: the account has to reach a certain trade volume, taxes must be paid upfront, or the withdrawal must be “approved” by a supervisor.

Weeks later, the investor finds communication slowing down or stopping altogether. Account access may be restricted, or the platform may claim technical issues preventing withdrawals.

Step 4: Total Silence

Finally, once the user insists on withdrawing or stops depositing, AlfaTrade representatives often disappear. Emails go unanswered, phone lines stop working, and the trading account becomes inaccessible. By then, the investor’s money is long gone.

4. Why Lack of Regulation Is So Dangerous

Legitimate trading platforms must hold licenses from recognized financial authorities such as the FCA, ASIC, CySEC, or similar bodies. These regulators enforce strict rules about:

-

Client fund segregation (keeping investor money separate from company funds).

-

Capital requirements to ensure solvency.

-

Transparency in pricing and trade execution.

-

Mechanisms for dispute resolution and complaints.

Unregulated brokers like AlfaTrade avoid these requirements. Without regulation, they can manipulate accounts, refuse withdrawals, or disappear with client funds without any legal consequence. Traders have virtually no recourse once funds are transferred to such entities.

5. How the Scam Likely Operates

Based on victim reports and the behavioral pattern observed across similar schemes, AlfaTrade’s operation can be summarized as follows:

1. Lead Generation

The platform collects leads through online advertising and social media. The promise of “easy profits” attracts new traders.

2. Personalized Sales Pressure

Potential clients receive calls or emails from persuasive “account managers.” These representatives are skilled at emotional manipulation — appealing to hopes of financial independence or fear of missing out.

3. Initial Deposit and Simulated Success

Once a deposit is made, clients see instant paper profits. These fabricated results create the illusion of a functioning trading platform. The client is encouraged to invest larger sums.

4. Blocked Withdrawals and False Explanations

When the client attempts to withdraw, the story changes. They are told that taxes or fees must be paid first, or that additional deposits are required to process the withdrawal.

5. Disappearance

After extracting as much money as possible, AlfaTrade.com representatives stop communicating. The platform may shut down, or the website may move to a new domain.

6. Rebranding

Fraudulent companies often relaunch under new names to target fresh victims. The pattern of design, communication style, and promises remains the same, just with different branding.

6. The Psychological Manipulation Behind It

Fraudulent brokers thrive on emotional and psychological tactics. AlfaTrade’s communication style appears carefully designed to exploit trust and greed:

-

Urgency: “This opportunity won’t last; act now!”

-

Authority: Posing as financial experts or senior traders.

-

Reciprocity: Offering “bonuses” or “welcome credits” to make clients feel indebted.

-

Fear of loss: Suggesting that failing to invest more means missing life-changing profits.

This manipulation can make even cautious individuals believe they are dealing with a legitimate broker. By the time doubts arise, it is often too late.

7. What to Do if You Have Been Involved

If you’ve already engaged with AlfaTrade.com and suspect you have been scammed, it’s crucial to take swift and methodical action.

-

Stop all communication with the platform and its representatives. Do not send additional funds under any circumstances.

-

Gather evidence — screenshots, receipts, emails, and transaction records. These will be vital for any potential investigations.

-

Contact your payment provider or bank to report the transaction as fraudulent. Depending on the method used (credit card, bank transfer, etc.), you might be able to file a dispute or chargeback.

-

Report the case to your national financial regulator or cybercrime authority. Even if they cannot retrieve your funds, your report helps prevent others from being scammed.

-

Inform friends or family who might also be targeted by similar schemes. Awareness is one of the strongest defenses against online investment fraud.

8. Lessons from the AlfaTrade.com Case

The AlfaTrade situation serves as a strong reminder that not everything that looks professional online is trustworthy. Here are the main takeaways:

A) Always Verify Regulation

Before investing with any online broker, check its license with a reputable regulator. If the company cannot provide a valid license number that can be independently confirmed, walk away.

B) Research Before Depositing

Search for customer reviews, complaints, and public records. Consistent reports of blocked withdrawals or unresponsive support are clear red flags.

C) Test Withdrawals Early

Even with legitimate brokers, it’s wise to start with a small deposit and try withdrawing early. If delays or strange conditions appear, that’s your signal to stop.

D) Don’t Fall for Guaranteed Profits

No financial market guarantees consistent profits. Any broker promising huge or effortless returns is not being honest.

E) Be Skeptical of “Account Managers”

Scam brokers often assign fake account managers who act friendly but are essentially sales agents trained to keep you depositing more.

9. Safer Trading Alternatives

For those genuinely interested in trading or investing, there are plenty of legitimate, regulated options. Reputable brokers typically:

-

Provide transparent fee structures.

-

Are licensed under established regulatory authorities.

-

Allow quick and verifiable withdrawals.

-

Offer risk warnings and educational resources rather than unrealistic promises.

Before opening an account, check reviews from credible financial publications and confirm the broker’s license number on the regulator’s official website.

10. Final Thoughts

The AlfaTrade.com saga is a textbook example of how online investment scams operate under the disguise of professional-looking trading platforms. It relies on slick marketing, emotional manipulation, and fabricated trading results to convince users to invest money — only to trap them in a web of false conditions and disappearing promises.

Every sign — from lack of regulation and confusing ownership details to hundreds of user complaints — points to AlfaTrade being a fraudulent operation. If you are approached by anyone representing this company, the safest choice is to ignore their offers and avoid engaging altogether.

In an age where digital scams are more sophisticated than ever, vigilance and due diligence remain the best protection. Always verify who you’re dealing with, confirm their regulatory status, and remember: if it sounds too good to be true, it probably is.

Report AlfaTrade.com Scam and Recover Your Funds

If you have lost money to AlfaTrade.com, it’s important to take action immediately. Report the scam to LOSTFUNDSRECOBERY.COM, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like AlfaTrade.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud. Read More reviews at Scams2Avoid