Introduction

In the world of online trading, new brokerages appear every month, promising high returns, advanced platforms, and round-the-clock support. But while some are legitimate, many others are cleverly designed traps that lure investors with flashy marketing and deceptive assurances. One name that has recently attracted attention and controversy is TradingPro.com.

In this comprehensive review, we’ll take an in-depth look at TradingPro.com, analyzing its operations, customer complaints, red flags, and overall credibility. The goal is simple — to determine whether this platform is a trustworthy trading broker or yet another scam disguised with professional marketing.

What Is TradingPro.com?

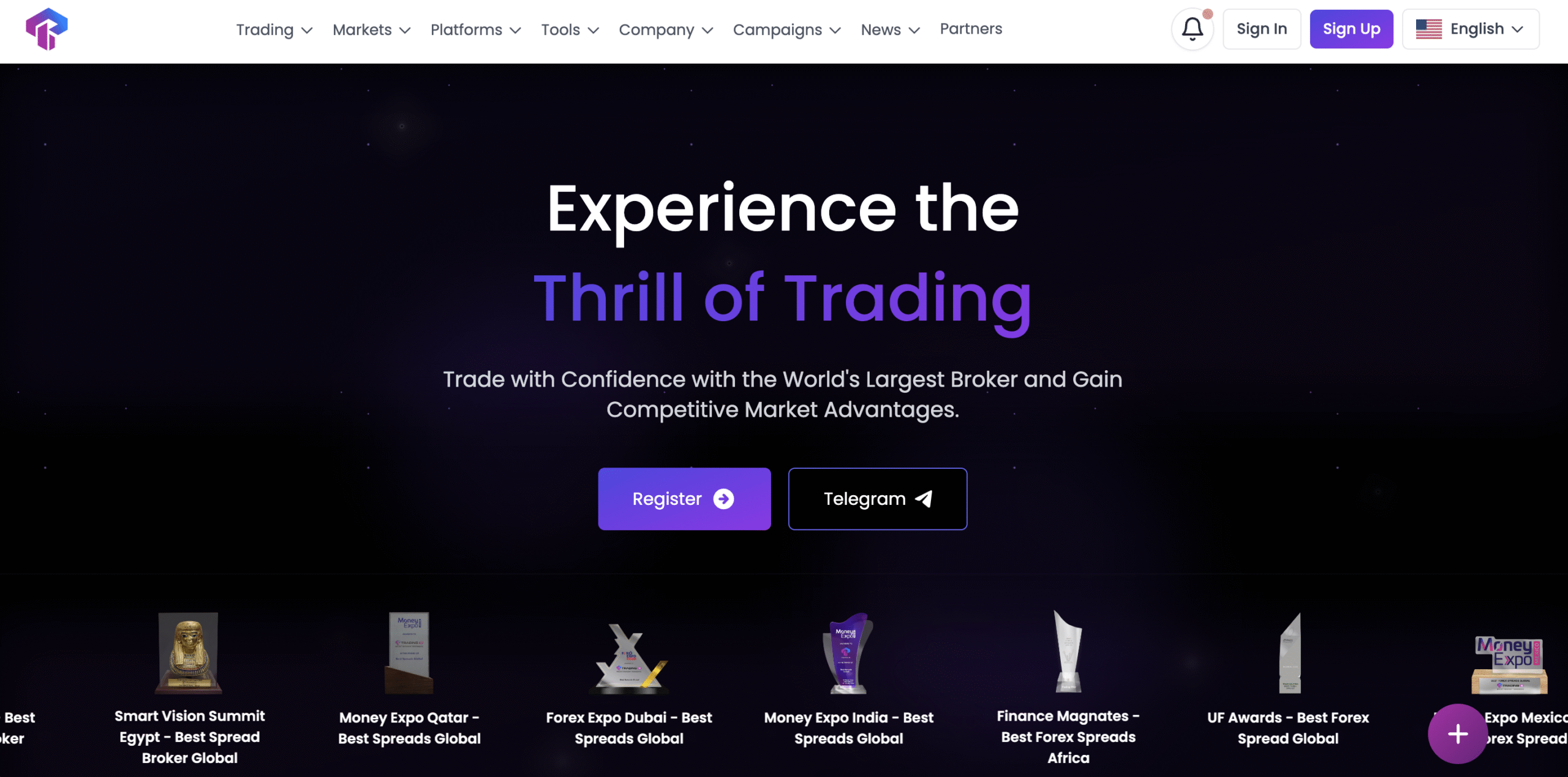

TradingPro.com claims to be an international online broker offering access to a wide range of financial instruments, including Forex, CFDs, commodities, indices, and cryptocurrencies. The company markets itself as a fast, flexible, and technology-driven brokerage aimed at both beginners and experienced traders.

At first glance, the website appears sleek and professional. It advertises:

-

Low spreads and fast execution

-

High leverage options (up to 1:1000 or more)

-

Multiple account types for different trader levels

-

Promotional bonuses and loyalty rewards

-

Support for popular trading platforms like MetaTrader 4 (MT4)

These offerings seem appealing — especially to newer traders looking for big opportunities with small investments. However, the surface polish often hides deeper issues, especially when a platform’s legitimacy is unclear.

Regulatory Concerns

The biggest red flag with TradingPro.com revolves around its lack of clear regulatory oversight.

A reputable broker must hold a valid license from a well-known financial authority — such as the FCA (UK), ASIC (Australia), CySEC (Cyprus), or other recognized regulators.

TradingPro.com, however, does not publicly display verifiable licensing information. While it may mention offshore entities or claim to be “regulated under international law,” those statements carry little meaning without confirmation from a trusted regulatory body.

Unregulated brokers can operate without the consumer protection, oversight, and financial transparency that regulated firms are bound by. This means:

-

Client deposits are not protected or insured.

-

The company’s operations are not audited.

-

There’s no external authority ensuring fair trading practices.

For any trader, the absence of a verifiable license is the first and most serious warning sign.

User Complaints and Customer Experiences

While the company showcases positive testimonials and claims to have thousands of satisfied clients, independent user reviews tell a different story.

Common complaints include:

1. Withdrawal Problems

Many users report that withdrawing funds from TradingPro.com becomes increasingly difficult after depositing larger amounts. Traders describe experiences where:

-

Withdrawal requests are delayed for weeks or months.

-

Customer support stops responding once withdrawal requests are submitted.

-

Additional “verification documents” are repeatedly requested without progress.

These tactics are commonly used by fraudulent brokers to delay or avoid paying out client funds.

2. Aggressive Sales Tactics

Several traders mention being contacted by “account managers” who pressure them to deposit more money to access “exclusive” trading opportunities or bonuses. These representatives often promise guaranteed profits — a clear red flag in legitimate trading.

3. Poor Customer Support

Support channels like live chat or email reportedly provide limited help. Some users claim that after initial deposits, responses become robotic, scripted, or disappear entirely once complaints arise.

4. Manipulated Trading Conditions

A number of users allege irregularities in trade execution — such as sudden price spikes, unexplained stop-outs, and chart discrepancies that favor the broker. This type of manipulation is common in platforms where the broker controls the backend trading environment.

While not every user has had a negative experience, the volume and consistency of complaints strongly suggest that TradingPro.com operates with questionable business practices.

Red Flags That Suggest TradingPro.com Could Be a Scam

1. No Verifiable Regulation

Any legitimate broker proudly displays its license number and regulatory body. The absence of this information is a major red flag.

2. Unrealistic Leverage and Bonuses

High leverage ratios (e.g., 1:1000 or higher) and deposit bonuses may seem like attractive offers, but they often come with hidden conditions — such as minimum trading volumes that make withdrawals nearly impossible.

3. Non-Transparent Company Information

A trustworthy broker clearly lists its physical address, company registration number, and ownership details. TradingPro.com provides limited or inconsistent information about its headquarters and legal entity, raising questions about who actually controls the company.

4. Reports of Blocked Accounts

Traders have complained about sudden account suspensions without explanation, often following profitable trades or withdrawal attempts. Such practices are common among unregulated brokers who manipulate access to funds.

5. Overly Positive Marketing

When a platform spends more effort on aggressive marketing than on proving its legitimacy, it’s usually cause for suspicion. TradingPro.com’s focus on promotions, social media advertising, and influencer partnerships appears to outweigh its transparency and accountability.

Inside Look at the Business Model

Many scam brokers operate under the same basic structure — and TradingPro.com appears to fit the pattern.

-

Attract new traders through heavy advertising and bonus offers.

-

Encourage larger deposits with promises of mentorship, VIP accounts, or automated trading systems.

-

Delay or deny withdrawals once users attempt to cash out profits.

-

Disappear or rebrand once complaints and bad reviews accumulate.

Because unregulated brokers can easily change their domain names and marketing materials, they can continue the same operations under different branding — often targeting a new group of unsuspecting investors.

Marketing Tactics Used by Questionable Brokers

TradingPro.com’s online footprint includes aggressive digital marketing strategies that are typical of high-risk brokerages. These include:

-

Social Media Advertising: Eye-catching ads promising “easy profits” or “copy trading with zero risk.”

-

Affiliate Programs: Incentivizing influencers and website owners to bring in new deposits for commissions.

-

Bonus Traps: Offering deposit bonuses that secretly lock trader funds until unrealistic trading targets are met.

-

Fake Testimonials: Using generic or staged positive reviews to drown out genuine negative feedback.

Such tactics aim to create the illusion of legitimacy and popularity while concealing the true nature of the business.

How TradingPro.com Differs from Legitimate Brokers

To understand why TradingPro.com raises concerns, it’s helpful to compare it with characteristics of genuine, regulated brokers:

| Aspect | Regulated Broker | TradingPro.com |

|---|---|---|

| Regulation | Licensed by a recognized authority (e.g., FCA, ASIC) | No verifiable regulatory license |

| Transparency | Public company details, registration, and physical address | Limited or unclear ownership info |

| Withdrawals | Processed within stated timeframes | Reported delays and ignored requests |

| Client Protection | Funds segregated in tier-1 banks | No evidence of segregation |

| Support | Verified, multi-channel assistance | Unresponsive or inconsistent replies |

This comparison highlights the gaps between TradingPro.com’s operations and industry standards for legitimate financial service providers.

Psychological Manipulation and Pressure Tactics

Scam brokers often rely not only on technology but also on psychological tactics to extract more money from victims. Traders have described interactions that follow a predictable pattern:

-

Building trust: Friendly account managers establish rapport and praise the trader’s “potential.”

-

Creating urgency: Clients are told they must deposit immediately to “lock in a special opportunity.”

-

Blaming the trader: If losses occur, clients are told it’s their fault for not following advice.

-

False reassurance: The company promises that bigger deposits will “recover losses.”

This emotional manipulation is designed to keep clients depositing while delaying withdrawals — until the broker disappears or blocks communication.

The Risk of Offshore Registration

Many unregulated brokers operate from offshore jurisdictions with loose or non-existent financial oversight. These include countries where registration is cheap and authorities have limited power to protect foreign clients.

If TradingPro.com is based in one of these jurisdictions, users have little to no recourse in case of disputes or lost funds. Offshore companies can shut down, rebrand, or reopen under a different name with minimal consequences.

Signs You’re Dealing with a Suspicious Broker

Even if you haven’t used TradingPro.com, it’s important to recognize the universal signs of a scam trading platform:

-

You’re contacted out of the blue with investment offers.

-

Profits appear on your account but can’t be withdrawn.

-

The broker requests more money to “unlock” your balance.

-

Customer service stops responding after you question transactions.

-

The website domain is new or recently changed names.

TradingPro.com exhibits several of these warning signs, suggesting a high-risk environment for traders.

Reputation and Online Presence

Despite claims of global reach, TradingPro.com’s online footprint is surprisingly shallow. Legitimate brokers typically have transparent corporate information, partnerships with liquidity providers, and mentions in reputable financial publications.

In contrast, TradingPro.com’s presence mainly consists of:

-

Paid advertisements.

-

Sponsored “review” articles lacking independent verification.

-

Mixed user feedback, often polarized between glowing praise and severe complaints.

This imbalance in reputation indicates that the positive content may be artificially inflated while negative reviews represent real user frustration.

The Illusion of Legitimacy

A common tactic among fraudulent brokers is to mimic the appearance of authenticity. TradingPro.com achieves this through:

-

Professional-looking website design.

-

References to well-known trading platforms like MT4.

-

Claims of fast execution and low spreads.

-

Mentions of “partner” organizations or technology providers (without proof).

These surface-level features create a sense of credibility but don’t guarantee genuine, regulated financial operations.

Potential Risks of Using TradingPro.com

-

Loss of Funds: With no oversight, deposited funds may be used at the company’s discretion.

-

Data Privacy: Providing personal identification and banking details to an unregulated entity exposes traders to potential data misuse.

-

Price Manipulation: The broker controls trade execution, allowing artificial spreads or fake market movements.

-

No Legal Recourse: Since the firm lacks credible regulation, clients have no reliable way to recover losses through official channels.

These risks collectively make TradingPro.com a dangerous choice for anyone serious about trading or investing online.

Conclusion

After examining its structure, complaints, and behavior, TradingPro.com shows nearly every hallmark of an untrustworthy broker. Its lack of regulation, reports of withdrawal problems, inconsistent communication, and questionable marketing practices all point toward a high-risk or potentially fraudulent operation.

While some traders claim to have had satisfactory experiences, the overwhelming evidence suggests that TradingPro.com cannot be considered a safe or transparent trading platform.

Traders should always prioritize safety over convenience. If a broker cannot prove its regulatory status or demonstrate transparent financial practices, it’s best to avoid depositing any money.

In summary, TradingPro.com is not recommended for anyone seeking a legitimate online trading experience. Always choose brokers with established reputations, verified licenses, and clear customer protection measures.

Report TradingPro.com Scam and Recover Your Funds

If you have lost money to TradingPro.com, it’s important to take action immediately. Report the scam to LOSTFUNDSRECOBERY.COM, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like TradingPro.com continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.