Introduction

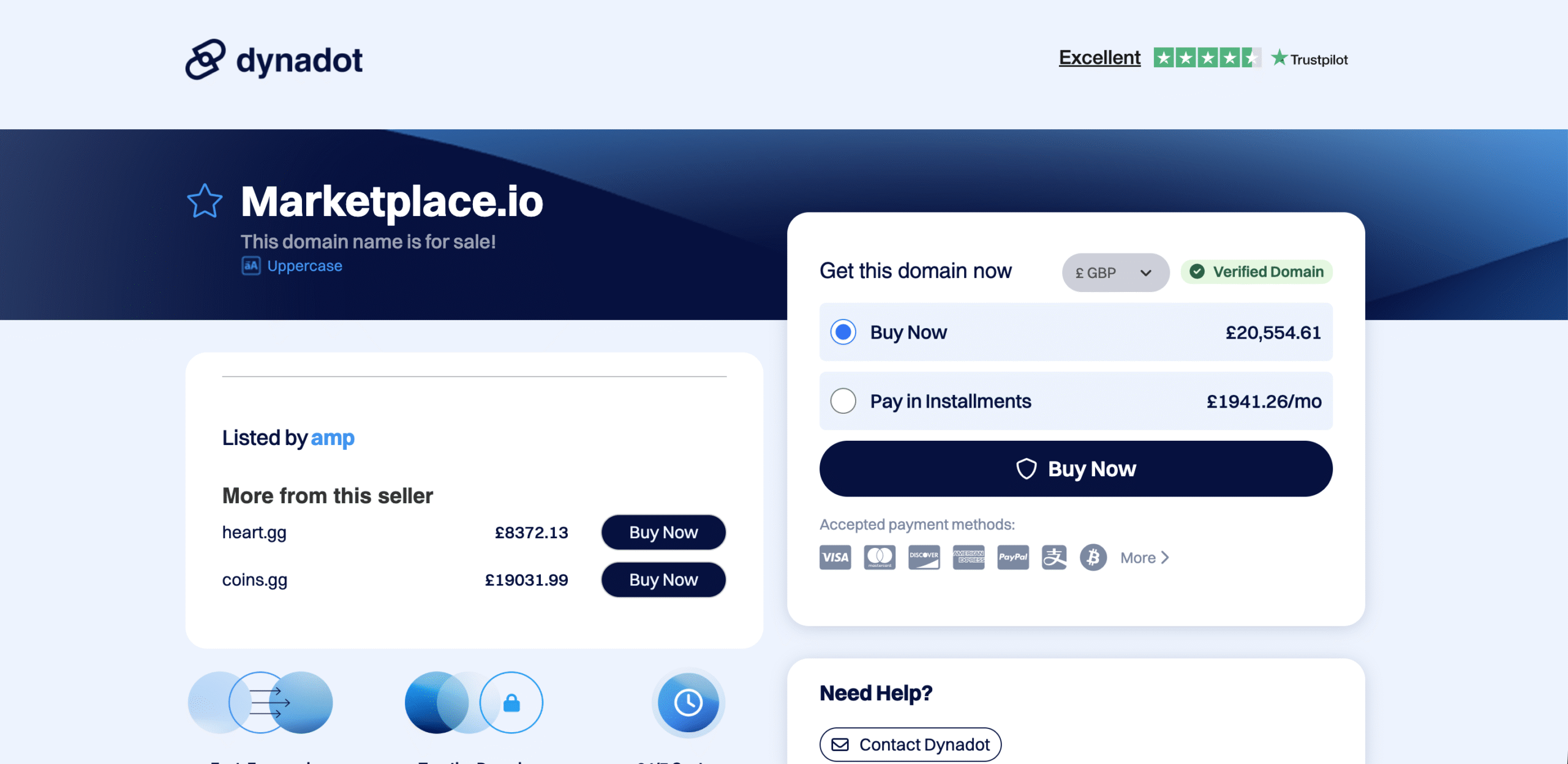

In recent months, Marketplace.io has become a hot topic among online traders, investors, and consumers. Many users were initially drawn in by its sleek website, impressive marketing claims, and promises of easy profits through its “innovative trading” and “investment” solutions. However, as more people began sharing their experiences, a troubling pattern emerged — countless reports of lost funds, blocked withdrawals, and unreachable customer support.

This article takes a deep, detailed look at why Marketplace.io is being called a scam, how it operates, and what signs of fraud users should recognize. The goal is to arm readers with knowledge — not only about Marketplace.io, but about the broader tactics such platforms use to deceive unsuspecting victims.

What Marketplace.io Claims to Be

At first glance, Marketplace.io presents itself as a modern digital marketplace offering trading, investment, or asset-management services. Its marketing materials use professional design, finance-industry terminology, and statistics that appear credible. The site often boasts about:

-

Advanced trading algorithms and “AI-driven” tools

-

Experienced financial managers ready to assist clients

-

High returns with minimal risk

-

24/7 customer service and “secure” account systems

These claims are deliberately chosen to inspire confidence. Scammers understand that people associate professionalism and technical sophistication with legitimacy. By mimicking the design language and tone of genuine investment platforms, Marketplace.io creates an illusion of authenticity.

The First Red Flags

Despite its polished appearance, Marketplace.io shows several red flags that should make any potential investor pause. Some of the most prominent warning signs include:

-

No verified company information.

There is no clear information about who owns or operates the platform. Legitimate brokers always disclose corporate details, physical addresses, and regulatory affiliations. -

Lack of regulation.

No evidence suggests that Marketplace.io is registered with any reputable financial authority such as the FCA (UK), ASIC (Australia), or SEC (USA). Operating without oversight allows such platforms to manipulate user funds freely. -

High-pressure sales tactics.

Many users report receiving persistent phone calls or messages urging them to deposit more money immediately to “take advantage of a limited-time opportunity.” -

Unrealistic profit promises.

Any website guaranteeing high or consistent profits with little to no risk is misrepresenting the realities of investing. -

Difficult withdrawal process.

Once users deposit funds, they often find it nearly impossible to withdraw their money. Requests are delayed, ignored, or subjected to unreasonable conditions. -

Anonymous or untraceable payments.

The platform frequently encourages payments through cryptocurrency or direct wire transfers — both methods that provide little recourse for victims once funds are sent.

How the Scam Typically Unfolds

Based on hundreds of user testimonies and pattern analysis, Marketplace.io follows a predictable, manipulative sequence designed to extract as much money as possible from victims.

1. The Bait — Enticing Marketing and Promises

Potential investors first encounter Marketplace.io through online ads, social media posts, or unsolicited emails. These ads promise “guaranteed returns,” “passive income,” or “an exclusive investment opportunity.” The language is persuasive, the imagery professional, and the call to action urgent.

2. The Hook — Friendly “Account Managers”

Once users register, they are often contacted by a “financial advisor” or “account manager.” These individuals sound knowledgeable and reassuring. Their job is to gain trust and persuade users to make their first deposit — typically a small one, such as $250 or $500.

3. The Illusion — Early Profits

After depositing, users are shown a trading dashboard displaying growing profits. In reality, these numbers are fabricated or manipulated by the platform’s internal software. The goal is to build confidence and encourage additional deposits.

4. The Escalation — Bigger Investments

When the victim appears satisfied, the “advisor” begins urging them to invest larger sums to “unlock higher-tier benefits” or “maximize their returns.” They may even show fake portfolio growth to pressure users into depositing thousands more.

5. The Trap — Blocked Withdrawals

Eventually, when users try to withdraw their money, problems begin. The platform introduces delays, demands extra verification, or invents new fees (like “tax payments,” “account upgrade charges,” or “release fees”). No matter how much users comply, their funds remain inaccessible.

6. The Disappearance — Vanishing Support

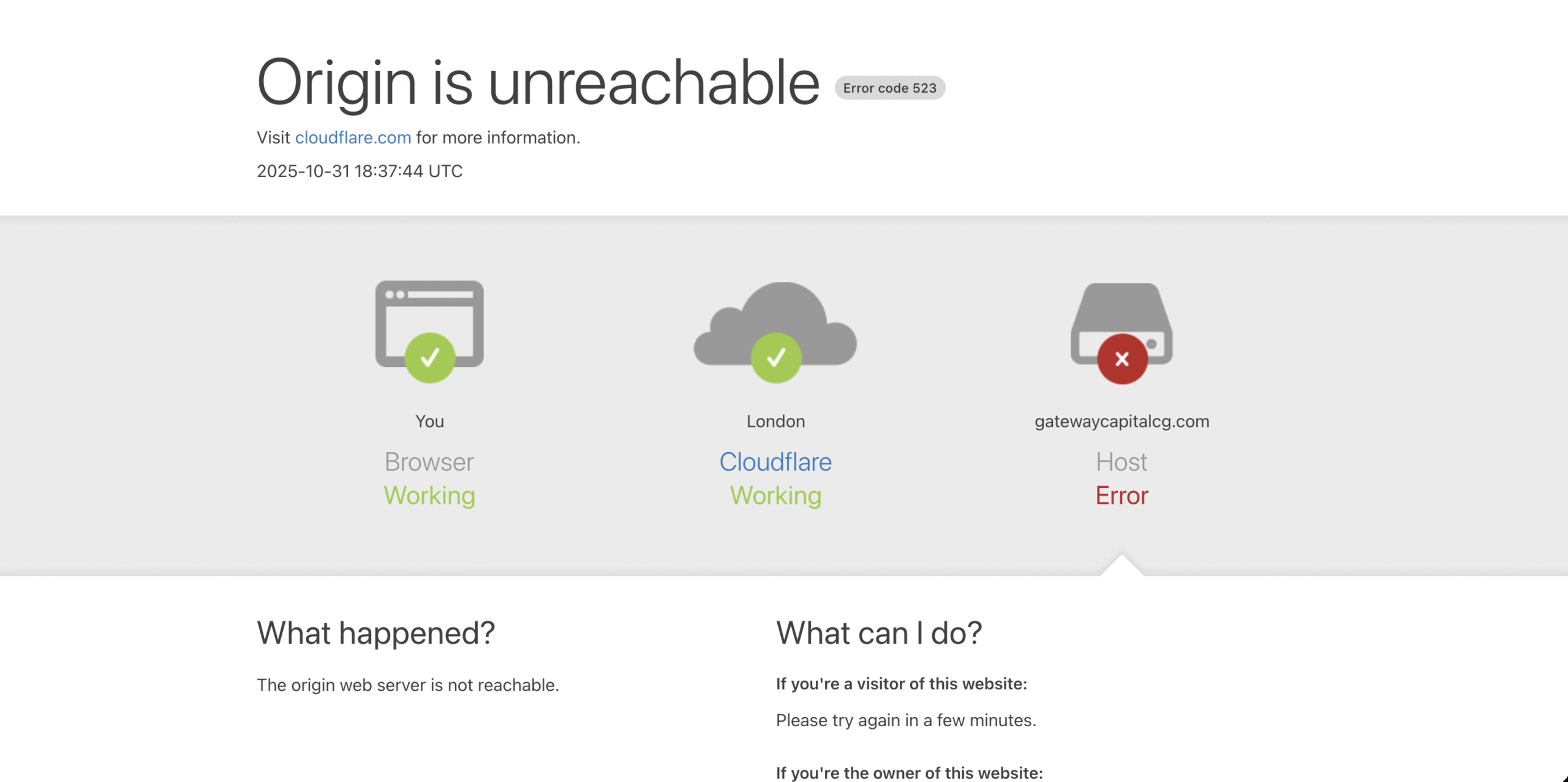

Once the victim refuses to pay more, communication abruptly stops. Support tickets go unanswered, emails bounce, and phone numbers are disconnected. The site might even go offline temporarily or reappear under a slightly different name.

Common Victim Experiences

The same patterns emerge across dozens of complaint forums and user discussions:

-

“They refused to process my withdrawal after I asked for my profits.”

-

“They demanded extra fees before releasing my money.”

-

“My account suddenly got locked after I stopped depositing.”

-

“Customer support just stopped replying — it’s like they vanished.”

Such repetition of experiences across unrelated individuals strongly indicates a coordinated, systematic scam rather than isolated customer-service failures.

Why Marketplace.io Is Dangerous

There are multiple layers to the danger Marketplace.io poses to users — financial, personal, and digital.

1. Financial Loss

The most obvious consequence is losing deposited money. Victims may lose anywhere from a few hundred to tens of thousands of dollars. Once the funds leave your account, recovery becomes extremely difficult because the operators hide behind fake corporate identities and offshore payment processors.

2. Identity Theft

Scam platforms often ask users to upload ID documents for “verification.” These can later be resold or misused for further fraud, including opening bank or trading accounts in victims’ names.

3. Psychological Manipulation

The scam relies heavily on emotional pressure. Victims are made to feel they’re missing out, or that they’ve already “committed too far to turn back.” Many describe feelings of shame or helplessness after realizing they’ve been tricked — a reaction the scammers exploit to delay exposure.

4. Data Harvesting

Even if a user never deposits money, simply signing up gives scammers valuable information — names, phone numbers, and emails that can be sold or used for future scams.

Technical Red Flags

A deeper look at the technical side of Marketplace.io reveals further issues:

-

Hidden domain ownership:

WHOIS lookups show that the domain’s registration is hidden behind privacy services. Reputable companies rarely conceal their identity in this way. -

Recent domain age:

The website domain appears to be relatively new. Scam platforms typically operate for a few months before shutting down or rebranding. -

Lack of HTTPS validation transparency:

Although the site uses HTTPS (as nearly all sites do), it relies on basic, free SSL certificates — providing no verification of organizational legitimacy. -

Duplicated platform templates:

The website structure and trading dashboard are identical to other known scam sites, suggesting the use of a common fraudulent template.

These factors confirm that Marketplace.io was likely built with minimal cost and designed to appear legitimate just long enough to collect deposits.

How Scammers Build Trust

Understanding their psychological playbook helps you recognize and resist future scams. The Marketplace.io strategy involves:

-

Authority appeal:

Scammers claim to work with analysts or firms that sound official but have no online trace. -

Scarcity and urgency:

Victims are told an “investment window” is closing or that they’ve been “personally selected” for a lucrative offer. -

Social proof:

They reference other “happy investors” or show fake dashboards of supposed clients making huge profits. -

Reciprocity:

The scammer may “help” you with a small issue at first — like guiding you through registration — to make you feel indebted and more likely to comply later. -

Commitment bias:

Once you’ve deposited once, they’ll remind you of your earlier decision to reinforce consistency and pressure you to deposit more.

The Broader Pattern — Clone Scams

Marketplace.io is not unique; it’s part of a larger ecosystem of cloned trading scams. These fraudulent websites share similar layouts, language, and business models. Once one domain gains too much negative publicity, the operators simply launch a new one using the same infrastructure. This recycling of scams makes it difficult for new investors to distinguish the copycats from genuine platforms.

Common naming strategies include:

-

Using professional-sounding tech terms (like “Market,” “Trade,” “Capital,” “Exchange,” “Pro”).

-

Registering domains with “.io” or “.co” endings to appear modern or international.

-

Copying content from legitimate brokers, slightly altering company names or license numbers.

The Emotional Aftermath

Many victims of Marketplace.io describe more than just financial pain — the emotional toll can be severe. Feelings of betrayal, embarrassment, and distrust linger long after the money is gone. Some individuals hesitate to invest or even bank online again. Recognizing these emotional effects is crucial, as scammers often rely on victims’ silence to continue operating unnoticed.

Lessons Learned

The Marketplace.io saga serves as a powerful reminder of the importance of due diligence. Key lessons include:

-

Always verify regulation independently.

Visit official regulator websites and search the company’s name or license number. Never rely on screenshots or “certificates” shown on the platform. -

Be skeptical of high returns.

Consistent, guaranteed profit does not exist in legitimate markets. -

Avoid unverified payment channels.

Stick to trusted payment methods that offer protection and traceability. -

Do not rush.

Pressure to act quickly is a psychological tactic. Real investment opportunities never expire overnight. -

Research reviews critically.

Identify authentic user feedback rather than paid or automated testimonials. -

Protect personal data.

Only share identification documents with regulated entities and through secure channels.

Building Awareness

One of the most effective defenses against scams like Marketplace.io is awareness. Sharing accurate information through blogs, forums, and community discussions helps prevent others from falling victim. Transparency exposes fraudulent operations faster and limits their ability to rebrand undetected.

Readers are encouraged to discuss their experiences openly. Doing so removes the stigma victims often feel and transforms isolated incidents into collective knowledge.

Why Regulation Matters

Financial regulation exists to safeguard investors. Licensed brokers must follow strict requirements:

-

Client fund segregation: keeping customer money separate from company funds.

-

Capital adequacy: maintaining reserves to ensure solvency.

-

Regular audits and transparency: proving that client transactions are real and fairly priced.

-

Dispute resolution channels: providing a legal pathway for complaints and compensation.

Unregulated entities like Marketplace.io ignore all these safeguards. They can disappear overnight without consequence. The lack of accountability is what enables them to defraud thousands of people with near impunity.

How Scams Evolve Over Time

Marketplace.io’s operators demonstrate how modern online fraud adapts. Years ago, scammers relied on crude websites and obvious lies. Today, they use professional branding, advertising algorithms, and social-media micro-targeting to reach specific demographics. They analyze investor psychology as carefully as legitimate marketers — only their goal is theft, not service.

The trend is especially dangerous because scams are becoming more convincing. Automated chatbots, fake AI-based dashboards, and deepfake testimonials blur the line between real and fake. In this environment, skepticism and independent verification are not optional; they are survival tools.

The Cost Beyond Money

Online fraud has broader consequences for digital trust. Every time a scam like Marketplace.io succeeds, it erodes confidence in online investment platforms in general. Honest startups and legitimate fintech companies suffer collateral damage as consumers become wary of all digital finance ventures. This collective loss of trust slows innovation and investment in the broader fintech ecosystem.

Key Takeaways

-

Marketplace.io operates without verified regulation, corporate transparency, or accountability.

-

Numerous individuals report identical experiences of lost funds, blocked withdrawals, and disappearing support.

-

The platform uses psychological and technical tricks to appear legitimate while concealing its true intent.

-

Once funds are deposited, users lose control, and the operators can vanish easily.

-

Similar scams continue to appear under new names — highlighting the need for constant vigilance.

Conclusion

Marketplace.io represents a textbook example of how sophisticated online scams exploit the trust and financial aspirations of everyday users. Through polished design, deceptive marketing, and manipulative communication, it creates the illusion of opportunity while systematically draining victims of money and confidence.

The lessons learned from this case apply far beyond one website. Every investor — beginner or experienced — must approach new financial platforms with a critical mindset, verify credentials independently, and recognize that if something sounds too good to be true, it probably is.

Marketplace.io may soon disappear or rebrand, but the tactics behind it will persist. By spreading awareness and demanding transparency, users can collectively limit the reach of such fraudulent operations and protect others from experiencing the same losses.

Report Marketplace.io scam and Recover Your Funds

If you have lost money to Marketplace.io, it’s important to take action immediately. Report the scam to LOSTFUNDSRECOBERY.COM, a trusted platform that assists victims in recovering their stolen funds. The sooner you act, the better your chances of reclaiming your money and holding these fraudsters accountable.

Scam brokers like Marketplace.io continue to target unsuspecting investors. Stay informed, avoid unregulated platforms, and report scams to protect yourself and others from financial fraud.